Are you considering buying and selling home at the same time?

There are a lot of considerations to make like where to live between selling and buying and how to come up with a down payment.

While it can be a bit tricky, it’s definitely doable with the right planning and strategy.

Keep reading for tips on how to make buying and selling homes at the same time go as smoothly as possible.

What to do if you’re considering buying and selling your home at the same time?

If you find yourself in the position of needing to buy and sell a home at the same time, there are a few things you can do to make the process easier.

First, it’s important to work with a real estate agent who is experienced in handling both transactions simultaneously.

They will be able to help you coordinate showings, open houses, and other logistics so that you can get the best price for your current home while also staying on track with finding your new one.

When trying to buy and sell a home a the same time, it’s not ideal to try one of these alternative ways to sell your house which can be beneficial in other situations.

Secondly, try to be as flexible as possible with your timing. As much as it would be ideal to close on both properties at the same time that may not always be possible.

A professional real estate agent can give your tips on how to buy another house before selling yours and vice versa.

Finally, be prepared for a little extra stress during the process.

Buying and selling a home at the same time can be daunting, but if you work with a professional and stay organized, you can make it through relatively unscathed.

Trend on the Rise

Add a rent-back clause to your contract. A rent-back clause is an addendum to a standard real estate contract that gives the seller the right to remain in the property and rent it back for a set period of time after closing. This gives you time to buy and close on your next home without the headache of moving twice.

Know the Current Market

When you’re buying and selling a home at the same time, it’s important to have a good understanding of the current market.

This will help you determine what is best for you to focus on first.

For example, in a buyers market, you may want to focus on getting the home you are selling under contract first since that could take longer.

You can look into some of these cheap ways to increase home value so you don’t lose money selling your house as is.

However, in a seller’s market, it could take multiple offers before you get one accepted so you might want to find your next home and be under contract before putting your current one on the market.

Work with an agent to come up with a plan that makes the most sense for you and your situation.

What are the different types of real estate markets:

- Seller’s Market – Has less than 3 months of inventory, meaning more buyers are looking for homes than homes available. This often results in multiple offers and homes selling above the asking price.

- Buyer’s Market – Has more than 6 months of inventory, meaning there are more homes available than buyers. This often results in homes selling below the asking price or taking longer to sell.

- Stable Market – Has 3-6 months of inventory and an equal number of buyers and sellers. This results in homes selling at or around the asking price and selling in a reasonable timeframe.

Know Your Financials

If you’re buying and selling a home at the same time, understanding your finances is key.

You’ll need to know the estimated resale value of your home and how much equity you have in it to apply towards your new home.

Talk to a mortgage lender to understand what you can qualify for and what you will need if your home doesn’t sell before you close on a new home.

In addition, many lenders require that borrowers have a certain amount of liquid assets on hand during the closing process.

As a result, it’s essential for sellers to have a clear picture of their financial situation before entering into any agreements.

By being mindful of all potential costs, sellers can avoid any stressful surprises down the road.

Tactic for Success

Rent out your old property. Depending on your circumstances, you may be better off renting out your old property. This can be a great investment, as the rent you receive can pay for your current mortgage and potentially offset some of your new home’s mortgage.

Buying a House Before Selling

Many homeowners who are selling their current home and buying a new one face the challenge of coming up with the down payment for the new home before the sale of their old one is complete.

There are a few different ways to overcome this hurdle.

A Bridge Loan

You may be able to get a bridge loan, which would give you the money for the down payment on your new home while you’re waiting for your current home to sell.

The downside is that bridge loans can be expensive and they typically need to be paid back within a year.

Tactic for Success

Add a contingency to the contract of the house you are buying that allows you to cancel the contract if you haven’t sold your home. This will give you some peace of mind and ensure that you don’t end up with two mortgages.

Home Equity Line of Credit

If you have equity in your current home, you may be able to get a home equity line of credit (HELOC).

This can give you the money for your down payment and you will only have to make interest payments until your current home is sold.

The downside is that if your home doesn’t sell within the draw period, you’ll be stuck with a HELOC and the associated payments.

Note that a HELOC draw period is typically between 5 to 10 years.

Borrowing From Family or Friends

You could borrow money from family or friends to come up with the down payment.

Just be sure to draw up an agreement so that there are no hard feelings later on.

Use Savings

If you have the savings, you could use that for the down payment on your new home.

This is usually the simplest solution, but it may not be an option for everyone.

You could also consider profiting from your current home by learning how to earn money with rentals or renting it short term and making money with Airbnb.

Trend on the Rise

Sell your house to an iBuyer. iBuyers are companies like Opendoor that will buy your home for cash, in as little as 14 days, without having to go through the hassle of listing it on the market. The downside is that you won’t get as much money for your home as you would if you sold it traditionally.

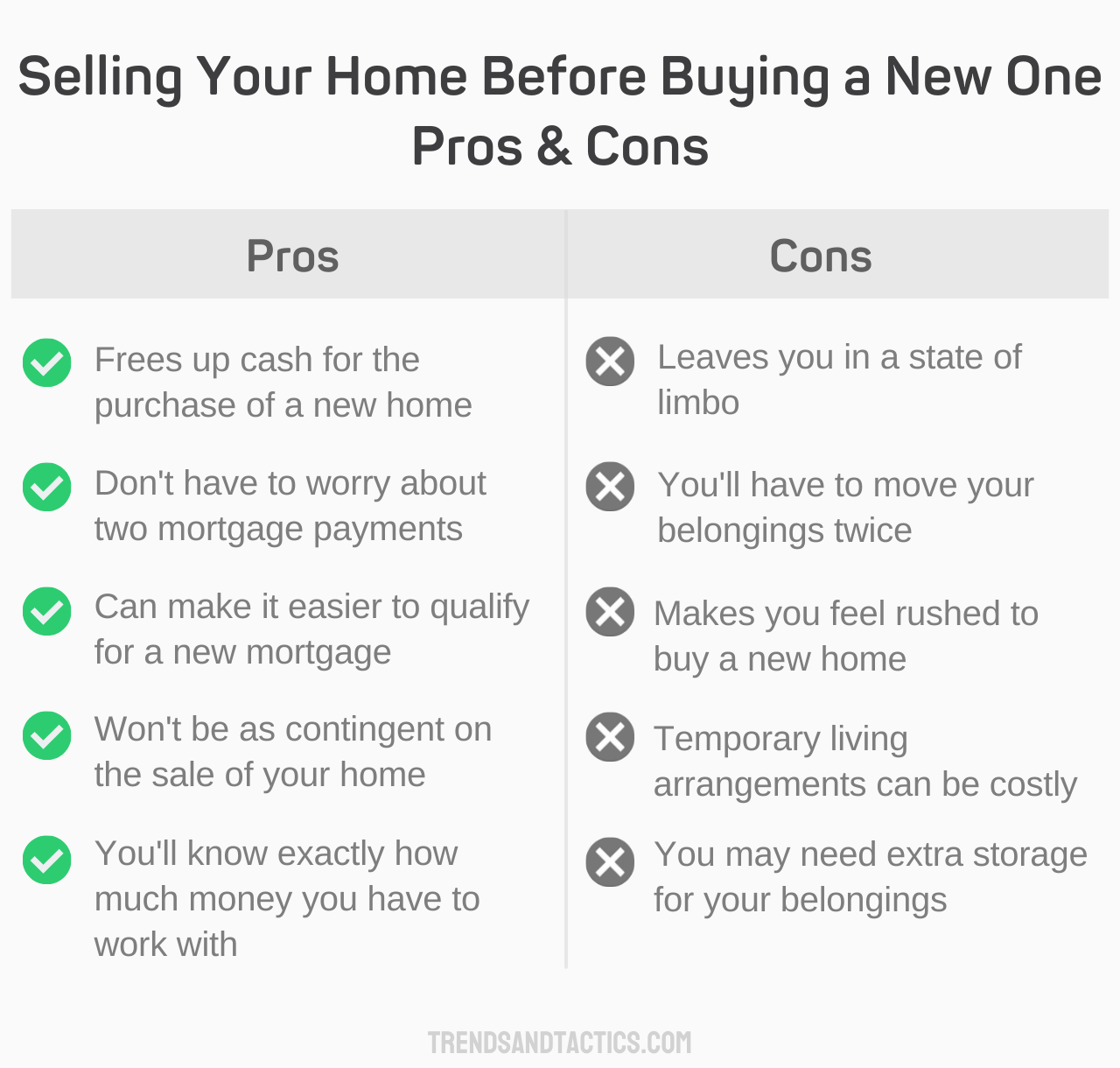

Selling a House Before Buying

When it comes time to move, many people opt to sell their current home before they purchase a new one.

There are a few advantages to this approach. First, by having the sale proceeds in hand, you can more easily afford your dream home.

Second, selling your home first reduces the financial stress of the situation by eliminating the need to carry two mortgages at once.

Finally, selling your house first allows you to declutter and simplify your life before you move into your new home.

However, there are a few things to keep in mind if you choose to take this route.

Make sure you have a plan in place for temporary housing, what to do with your stuff, and be pre-approved for a mortgage so when you do find your dream home you are ready to act.

When is best to sell your old home before buying a new one:

- You Don’t Want to Risk Having Two Mortgages – If you don’t have the savings to carry two mortgages at once, selling your old home before buying a new one is the best way to avoid that risk.

- You Can’t Qualify for Two Mortgages – If you can’t qualify for two mortgages, it’s best to sell your old home, use the proceeds to pay off the mortgage, and then qualify for a new mortgage.

- You’re Selling in a Slow Market – In a slow market, it could take weeks or months to sell your home. If you don’t want to carry two mortgages it’s better to sell first before buying.

Wrapping Up

The process of buying and selling a home at the same time can be complicated and overwhelming.

However, by having a great Realtor, knowing your financials, and being flexible, you can make the process easier and less stressful.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.