College is a significant step forward that can be both overwhelming and exhilarating.

From picking courses and majors to figuring out where you’ll stay and how you’ll afford to eat, it can feel like a lot of information is hitting you before you’ve even made it onto campus.

Disorganized finances gets overwhelming for some students, with 53% of students at some colleges being unable to come back for a second year.

Instead of panic, it’s time to prep and make a college student budget.

- Expenses associated with college

- How to track expenses

- How to pay for college (top 9 ways)

- Top tips to save more on college

This is the definitive guide on how to master budgeting as a college student.

What Expenses Are Associated With College?

College isn’t cheap, and nobody knows that better than college students.

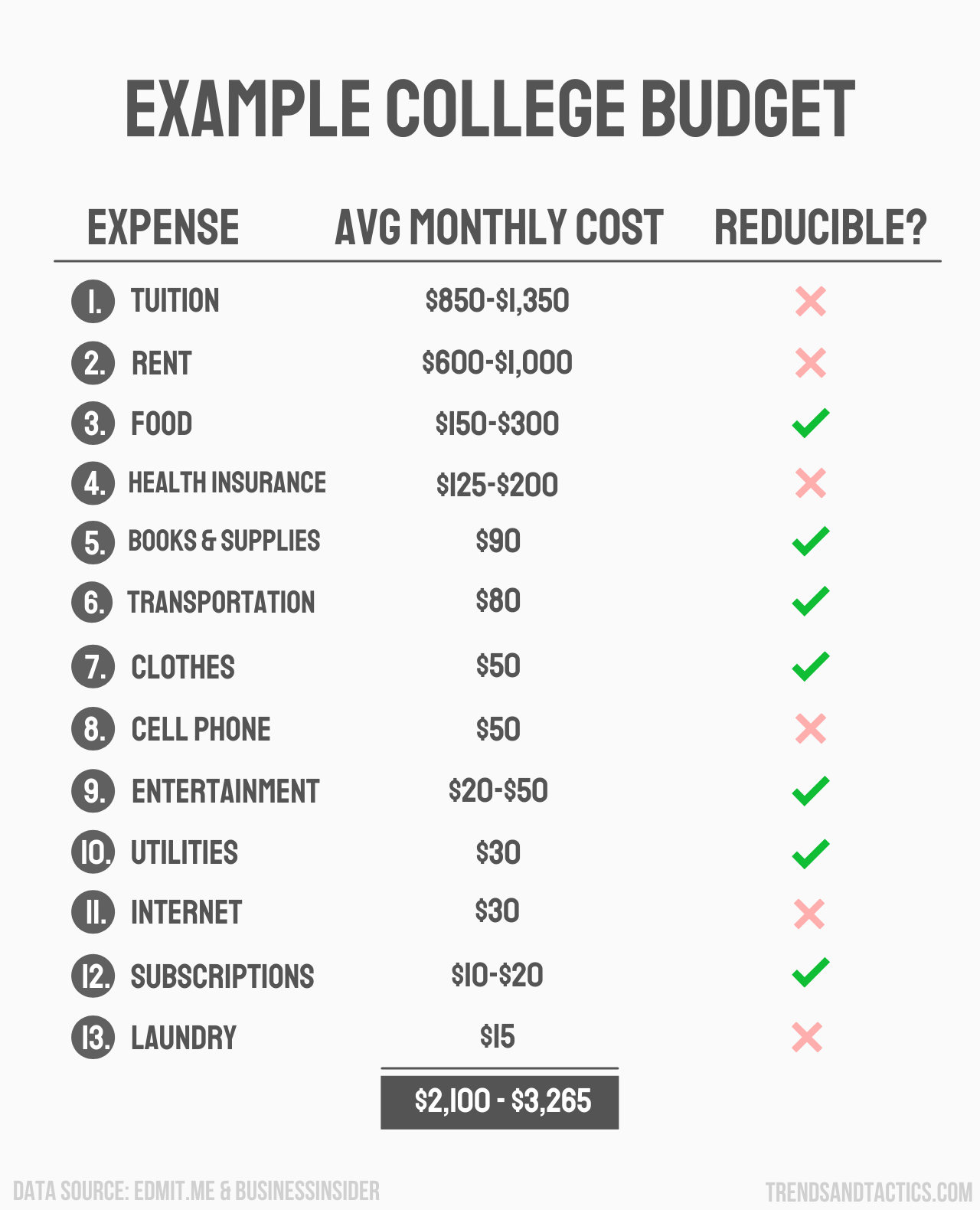

These are the core 8 expenses associated with college, necessary to maintain a good quality of life while developing high income skills at school.

1. Housing

Housing is an obvious need, but many don’t think about the cost. If you’re capable of staying with your parents and willing to do it, that’s the best way to save money here.

Otherwise, most students either rent an apartment near the school, pay to stay in dorms or pay to stay in their fraternity or sorority’s housing.

The rent costs depend on how many people you rent with, whether you’re in a city or rural area, and what type of housing you get.

Many students will find a good second job nearby to help offset this cost too.

2. Food

There’s a classic joke that college students live off of ramen and bowls of cereal because of how hard it is to afford anything significant on a college student budget.

Food can cost the average person $150 to $300 a month, depending on their tastes and eating habits.

It’s always cheaper to cook, but a budget should have room for ordering in or eating out. If you deny yourself what makes you happy, you’ll be less likely to stick to a plan and more likely to start spending on impulse.

3. Tuition

The cost of tuition varies from institution to institution. For those with a tight budget, it’s cheaper to go to local community colleges.

Unfortunately, many feel a robust societal push to go to more expensive schools or feel like they’ll be more successful if they go to a ‘better’ school, which can leave tuition at mind-bogglingly expensive heights.

4. Books

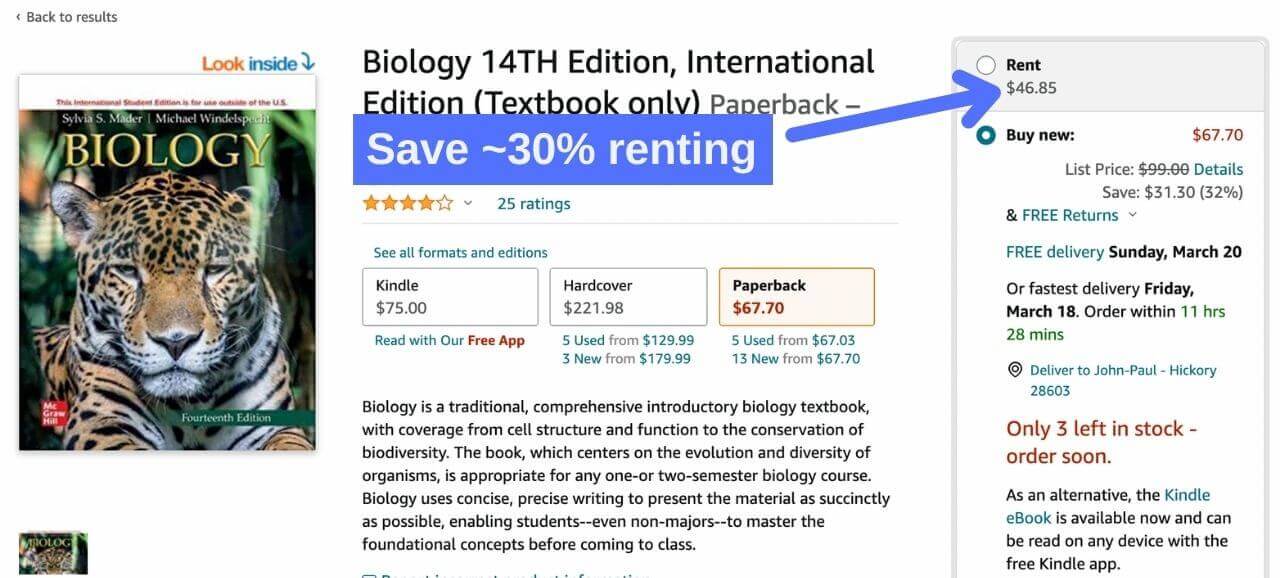

College textbooks are so expensive that there are entire subreddits and comic collections based on jokes about them.

The price is so high that 65% of students admit they’ve delayed buying a textbook for a necessary class because it didn’t fit in their budget. You can save money by purchasing a digital copy if possible, but most of the time, it isn’t.

5. Technology

Long gone are the days when you could bring in a notebook and a pencil.

Most college students have at least five pieces of technology that they call necessary to their education.

Common tech purchases by college students:

- Phones (average smartphone price is $550)

- Laptops or other computers (average price is $500)

- Tablets (average price is $300)

- Headphones (less than $100)

- Smart Bluetooth speakers (less than $100)

- Printers (less than $100)

- Smartwatches (average price is $400)

These are simple things that can impact students’ ability to complete work and focus, yet their price together adds up to almost two thousand dollars.

Some colleges give away tablets, but most don’t give students anything more than an education, making these handy tools unreachable.

6. Transportation

Students who want to save money by not staying on campus have to stare down the idea of transportation. Most cities have buses that lead to colleges, while others factor them into train and railway maps.

Unfortunately, for someone with a busy schedule or who lives too far away to be feasible, transportation is a lot more expensive.

Purchasing a starter car can run around $2,000, and then from there comes in auto insurance, gasoline, maintenance, and dozens of other little details that add up. The average car owner spends a couple thousand a year when these are combined.

If a student can’t drive or take public transit, they could have to foot the bill to be driven there, raising their college student budget exponentially.

7. Entertainment

We may go into college convincing ourselves we’re going to drop gaming and partying and focus solely on our education: but few people ever follow through with that.

You don’t have to let go of what makes you happy, but instead, pay attention to how much you spend. This means movies, streaming applications, eating out and partying, and generally anything else that’s fun and not free.

8. General Costs

Although your mind is on school and what you can do to ensure your bills are covered: your daily life still exists. Pay attention to what you spend in your everyday life currently.

Your phone bill, vet expenses for any pets, your health insurance, internet, and electricity: can add up quickly.

These general costs don’t vanish just because you’re in school, and for many students, it’s the first time they’ve experienced them outside of their parents paying. It would help if you learned how to track expenses.

How To Track Expenses

If you’ve never lived alone before, tracking expenses can be a lot to wrap your head around. Before you go to college, you must sit down and take a solid look at what you will have to pay every month.

For a couple of months before you start college, try to track how much you’re spending to see if you can find an average. This is best if you can track at least three months, but any amount of time can help bring awareness to your spending.

To track how much you spend, you can look into apps for your phone like Mint & Quicken, websites you can access on your laptop, or even go low-tech and write it down in a notebook like you’re balancing checks.

Be honest if you spend money, and don’t try to lie around it so that your budget isn’t scary. It would be best if you were prepared for what you’ll be paying.

How To Pay For College (Top 9 Ways)

If you’ve looked at your expenses and realized that college is too expensive for you, you’re not alone! The cost of college has increased by 25% since 2011.

This statistic is scary for many people new to college and staring down an already too-high price.

You don’t have to skip out on education, though.

Here are some of the top ways that people earn the money to cover their education.

1. FAFSA

The Free Application for Federal Student Assistance is a program that has put millions through school in a more affordable way.

Although it does cover the entire cost of college, it covers only a percentage, based on the student and their parents’ incomes. Other points also play in the decision, including when you apply.

Studies have found that students who apply within the first three months of FAFSA being open often receive up to 200% of what a later student receives.

This discrepancy may be because more desperate students apply earlier, but either way- it’s good to get your foot in the door early and try to receive help.

2. Parental Contribution

If you don’t get approved for FAFSA, it’s often because of how much money you or your guardians receive every month.

The current poverty line in America is $12,000 per year if it’s just you, or $26,000 if you live with two parents and one sibling. If your family makes far more than this, they may not approve your application.

The good news is, if your parents are making $100,000 or more, they’re an excellent place to go for monetary help. Most parents want to help, even if it’s not much.

Show that you’re going to work hard, be productive in your role as a student, and try not to be greedy. Although these people raised you, they don’t owe you school money.

3. Scholarships

Scholarships are the dream when it comes to saving money for college. You can apply to these over the phone or on the couch of your student counselor.

Be completely honest about yourself and your ambitions, and allow your brighter self to shine through.

Scholarships are often aimed at people who are left out by the current system. This targeting could mean that if you’re LGBT+, you search for scholarships aimed at you in your specialty and try to follow through.

Don’t be afraid to browse and search through scholarship databases; you can find some for random things like those left-handed or applicants in the Girl Scouts as a child.

4. Government Loans

If you’ve tried several methods and can’t get the money, a government loan may be a great fit. Not only are government loans fixed rate, but they’re also lower than some credit cards!

These loans are safer because you’re less likely to be harassed if you’re late and are more easily guaranteed.

5. Work-Study Program

Many schools offer students programs in less fortunate financial situations that allow them to work on campus to receive a discount on their education.

Most students can find a program that works with their major, like tutoring in math or English or helping clear off sports fields. These programs are also a fantastic way to get to know your fellow students and feel more like a part of your school.

Other options include high paying retail jobs, and food delivery services for students who need more flexible work schedules. .

6. CrowdFund

Let people know what you’re going to school for and what you want to do with your life afterward. If you’ve had a rough life so far, or there are things you feel like have been holding you back, more people are likely to donate.

People feel more compelled when there’s an emotional connection rather than just a financial one.

7. Attend A Less Expensive School

This answer may break some hearts, but if your school is unaffordable, and you find yourself scrounging for loose change to afford lunch: this school isn’t the best choice.

It would be best if you had a school that will let you lead a good work and life balance without clearing every last penny out of your pockets. You can even do two years at a local community college and then switch over to a more expensive one afterward to cut down on your costs.

Think of it as the difference between name brand and off-brand cereal: it tastes the same, it’s often made in the same way; the only difference is the labeling. The real thing that matters is what you learn and how you can use it.

8. Personal Loans

This option should only be explored if you’ve looked into everything else and came out empty-handed.

Recent studies have found that private loan companies are more predatory than ever, with almost 70% of current college graduating classes being saddled with debt. These loans use many tactics to try and take all of your money, and unfortunately, they’re often successful.

There are endless reasons not to use student loans, but the top ones are:

- The interest you’ll accrue is enormous.

- You can ruin your credit score while it’s still forming.

- You’ll still have to work while you study.

- The debt to income ratio can stop you from finding a future place to live.

- No, or minor, borrower protections.

- No borrowing limits.

When you’re making your way into the world for the first time and building your credit, the last thing you should want to do is put it all on the line for some quick money. Try some of these other options, and if they don’t work, try to be careful when picking your lender.

9. Saving Up Ahead

If you can’t afford college otherwise, but you can afford to take a couple of years off first to work, you should consider saving up ahead. Apps like Digit use AI technology to make saving effortless.

Not only will work experience help you understand your budget better, but it will also give you the chance to fill your savings account and avoid a loan.

This option isn’t available for everyone since most jobs people can get right out of high school don’t pay that well: but working and saving can get you going in the right direction.

How To Save More Money

One way to make college more affordable is to make money off of your current daily bills. These tips help you save money in other areas so that the funds you focus on school aren’t ever questioned.

Get More Roommates

Does your apartment have a guest room? Is there a small awkward room off of the living room you’re not sure what to do with?

The fastest way to cut down on living expenses is to get a roommate who can help share the financial burden. Cutting the rent of a $1,500 a month apartment down between three people instead of two will save you $250 on your monthly expenses.

Discounted Food

Stores like ALDI and discounted grocery shops are in every single city out there. Save money by seeking out as many deals as you can and getting whole good food.

If you notice you accidentally waste a lot of produce by forgetting to eat it, purchase the frozen variety instead so it will last longer.

Find Books Cheap or Free Online

Avoid buying your books in the school bookstore.

Instead, you can find them cheaper by using one of the following:

- Second handbook websites

- PDF sites with free or discounted copies

- Student forums

- Many school stores offer to rent instead

- Look for older editions

- Check it out at a library instead

- Share a book with a classmate you trust

Any of these options are better than having to pay the total price, averaging in the hundreds, for a book that you’ll use for one semester and then forget that you own.

When you finish with books, never sell them back to the school bookstore; they’ll underpay and leave you further broke.

Be Honest With Yourself

If there are vices in your life that are making it harder to afford college, you need to figure out if they’re worth having.

Some people go out drinking on the weekends, and they rack up bills of a couple of hundred dollars in a night, while others pour their money into video games they’ll play once and then tweet about.

Consider how you’re spending your money and how it’s affecting you financially. Although college’s high expense isn’t your fault, how you react to it and create a space that you can afford is up to you.

How to implement a budget successfully?

College can be expensive and difficult to manage. Many people find themselves struggling to make ends meet, and end up with a lot of debt. One of the best ways to budget money in college is to create a spending plan.

How to Budget as a College Student

There are some simple steps that any college student can take to stay on budget. The first step is to create a realistic budget. Make sure to account for all of your regular expenses, such as food and transportation.

Next, try to set aside money each month for unexpected expenses, such as car repairs or doctor’s visits.

Finally, be mindful of your spending habits. Track where you are spending the most money and look for ways to cut back.

Once you have a good understanding of where your money is going, you can start setting aside money each month for different expenses.

For example, you might want to create a “fun fund” for nights out or weekends away. Finally, don’t be afraid to adjust your budget as needed. As your income or expenses change, so should your budget.

How to Earn Money in College with No Job

There are many ways to earn money while in college without a job. For one thing, there are tuition waivers and financial aid available to help offset the costs of higher education.

Additionally, many students make money by taking on part-time jobs, either on or off campus. Another option is to sell items that you no longer need or use, such as clothing, books, electronics, or furniture.

This is also one of the best ways to get textbooks cheap, since you can buy and sell old textbooks to meet your needs at the time for individual classes.

And of course, many students take advantage of their skills and talents by working as freelancers or utilizing online platforms like Fiverr or Upwork.

Conclusion

College has become a necessity for almost every American in recent years, with an associate’s degree becoming the standard minimum for jobs.

If you spend money carefully and ensure you’re putting money into savings, you can make it through this without having to be broke.

Erin is a business teacher and mother of three. When she’s not in the classroom or fulfilling her obligations as an A+ hockey and lacrosse mom, she’s working on her latest article.