Are you interested in buying a foreclosure home? If so, you may be wondering how much do foreclosed homes sell for at auction.

Today, we will discuss what factors influence the price of a foreclosure home to give you an idea of how much you can expect to pay for one.

Plus the truth about buying a foreclosed home.

How Much Do Foreclosed Homes Sell for at Auctions

When a homeowner fails to make their mortgage payments, the home is typically foreclosed upon and put up for auction.

The goal of the auction is to sell the home for enough money to cover the outstanding mortgage balance.

In some cases, the home may be sold for more than the mortgage balance, but this is not always the case.

Homes that are in poor condition or located in less desirable areas may sell for significantly less than the outstanding mortgage balance.

In some cases, the home may not sell at all. When this happens, the lender will often take possession of the property.

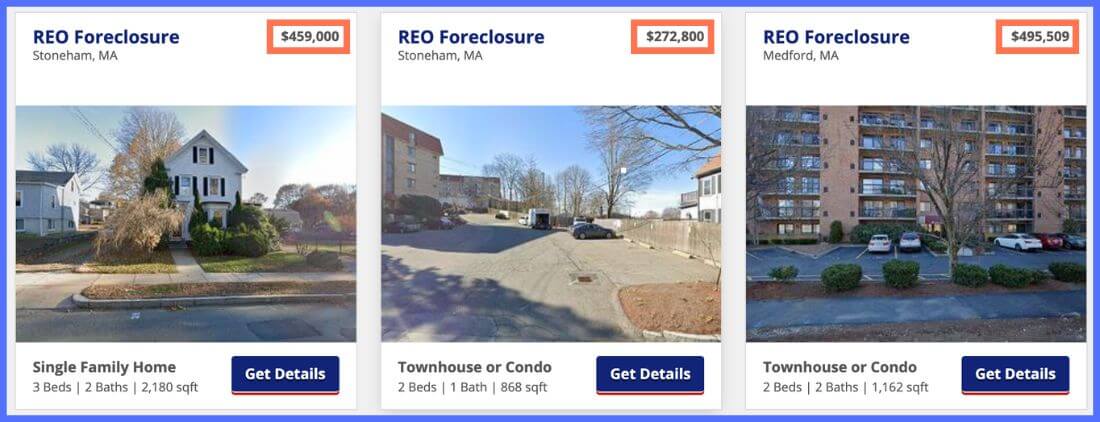

The average prices that foreclosed homes sell for can vary greatly depending on the location of the property. In general, foreclosed homes in urban areas sell for more than those in rural areas.

This is because there is typically more demand for homes in urban areas.

Additionally, the average prices that foreclosed homes sell for can vary depending on the condition of the property and whether it is a good time to buy a house or not.

Homes that are in good condition will typically sell for more than those that need significant repairs, something to be aware of if you’re buying a home with no inspection.

How Much to Offer on a Bank Owned Property

Given the current state of the economy, more and more people are finding themselves interested in purchasing bank owned properties a reduced rate.

A big question is how much to offer on bank-owned property. One important factor is the market value of similar properties in the area.

Trend on the Rise

It is becoming more common to have auctions online instead of in person. But it is important to do your research on the home beforehand and make sure you understand the process before you place your bid.

You will also want to take into account the repair costs that will be necessary to make the property livable.

Once you have calculated these costs, you can then make a decision as to how much to offer on the bank owned property.

Keep in mind if the banks have had a property for awhile they are more likely to be open to negotiation, so it is always worth submitting a lower offer and seeing if the bank is willing to meet you halfway.

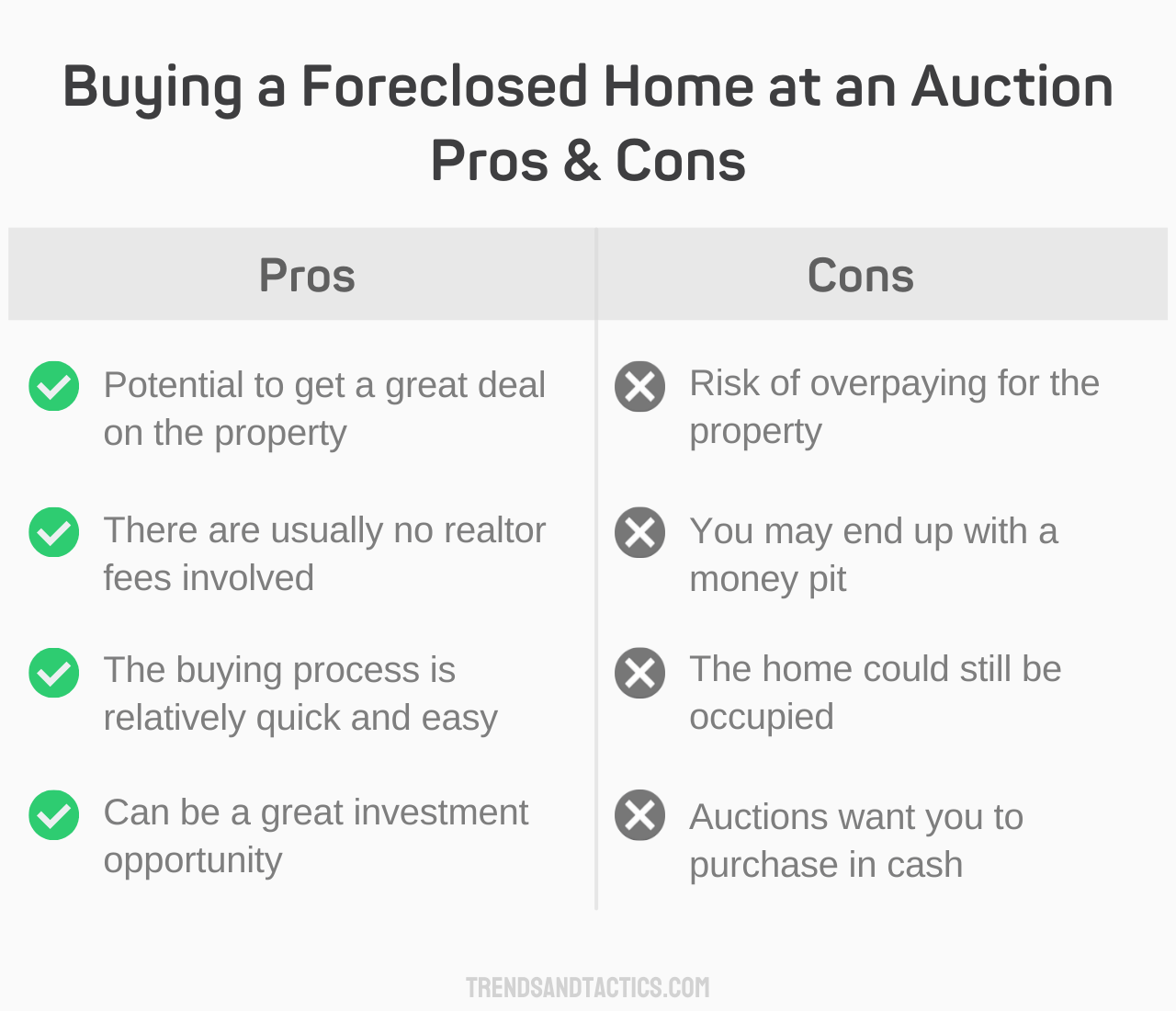

No matter what the real estate is, whether a foreclosed home or buying a mobile home, there are pros and cons to consider with every investment.

Tactic for Success

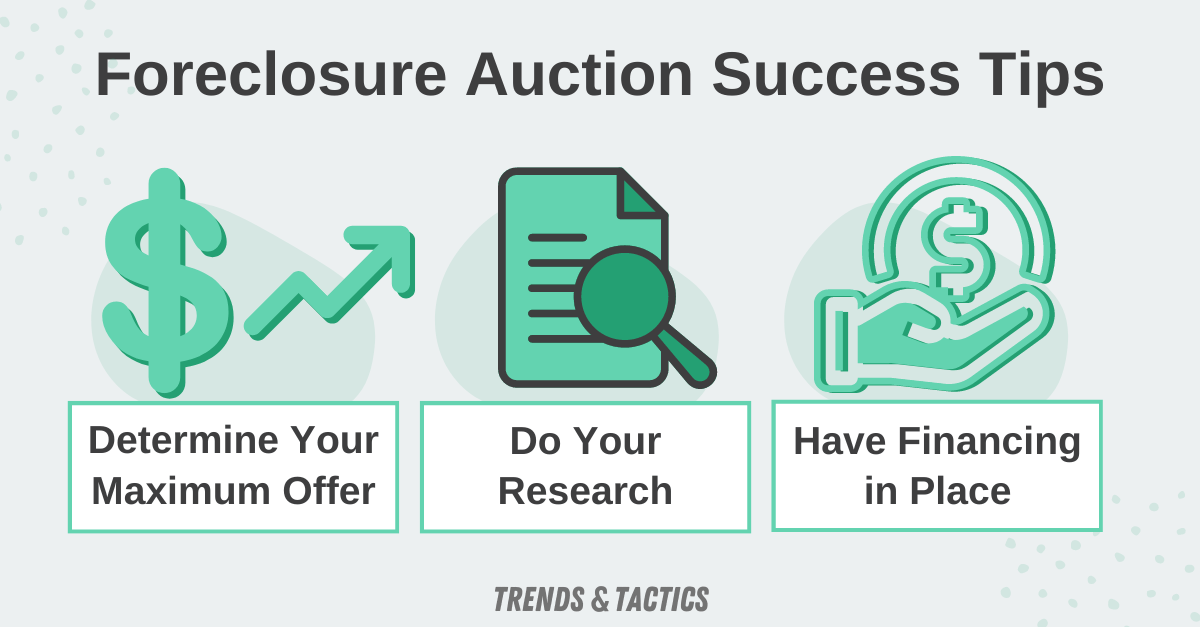

Know your limits. It is important to know your budget because it is easy to get caught up in the excitement of the auction and bid more than you can afford or the home is worth. Before bidding, make sure you know how much you are willing to spend. This will help you stay within your budget and avoid overspending.

How Buying a House at a Foreclosure Auction Works

First, it’s important to understand that foreclosure auctions are typically held by the lender (i.e., the bank) in order to recoup the unpaid balance of the mortgage.

The property is put up for sale at a public auction, and the highest bidder wins. It’s important to note that often the winning bid must be paid in full at the time of the auction.

In most cases, this means having cash on hand or having pre-arranged financing in place, which is can be typical in many alternative ways to sell a house.

If you’re not able to pay the full amount immediately, you may be able to work out a deal with the lender.

However, this is not normally possible, making buying and selling a home at the same time difficult with foreclosure auctions.

It’s also important to understand that the winning bid at a foreclosure auction may be less than the outstanding balance of the mortgage.

In this case, the lender would take possession of the property. Additionally, if there are no bids at a foreclosure auction, the lender will typically take possession of the property.

Tactic for Success

If you want to finance your house but the auction doesn’t allow it you can pay in cash and do delayed financing. Delayed financing essentially allows you to refinance your home within a certain time frame after purchase. Keep in mind not all lenders offer this option, there may be fees associated and you will need good credit.

Are Auction Houses Profitable

Auctions can be a great way to get a good deal on a property, but there are also a few things to keep in mind before making a purchase.

First of all, it’s important to do your research and know what you’re bidding on. There’s no point in overpaying for a property just because you got caught up in the excitement of the auction.

It’s also important to be aware of the potential risks involved in buying a property at auction. Houses that are sold at auction may have hidden damage that you’ll be responsible for repairing.

You also won’t have the opportunity to inspect the property before making your purchase, so you’ll need to be comfortable with taking on some risk.

But if you’re willing to do your homework and take on a bit of risk, buying houses at auction can be a great way to score a great deal on your next investment property.

Trend on the Rise

Wholesaling houses. Wholesaling is the process of finding deeply discounted properties and selling them to another investor for a quick profit. Unlike fix-and-flips, which involve renovating a property and then selling it, wholesalers simply find properties that they believe they can sell for more than they are paying and then find an investor to buy the property from them.

Risks of buying at a foreclosure auction:

- Overpaying for Home – It can be easy to get caught up in bidding and overpay for the home.

- As-is Sale – Most foreclosure auction sales are as-is, which means that the home is sold in its current condition.

- HOA or Other Liens – There is a possibility that there could be HOA dues or other liens on the property that the new owner will be responsible for.

- Back Taxes – The new owner may also be responsible for any back taxes that are owed on the property.

- Limited Time and Ability to Do Due Diligence – It can be difficult to fully assess the condition of the property or any potential problems that it may have.

- The Property Could Still Be Occupied – There is a possibility that the property could still be occupied by the previous owner or tenants. This can create a number of problems, including needing to evict the occupants.

- Home Needs More Repairs Than Estimated – The home may need more repairs than you originally estimated, which can end up costing you more money.

$1 House Auctions

Every so often, a story hits the news about someone who bought a house for an incredibly low price at an auction. It sounds like a dream come true, but there’s usually more to the story than meets the eye.

These houses are often in need of significant repairs, and the cost of those repairs can quickly eat up any savings from the purchase price.

In addition, many of these homes are located in less-than-desirable neighborhoods, which can impact both quality of life and resale value.

As a result, anyone considering bidding on a $1 house should do their homework first to make sure they understand the true costs and risks involved.

Otherwise, they may end up with a money pit instead of a bargain.

How to be successful at a foreclosure auction:

- Determine Your Maximum Offer and Stick to It – It can be easy to get caught up in the excitement of the auction and end up spending more than you had originally planned.

- Do Your Research – You most likely are not allowed to enter the property before the auction, so it is important that you research and if possible drive by the home.

- Have Your Financing in Place – You will need to have your financing in place ahead of time. This means either having cash on hand or having a pre-arranged loan.

- Be Prepared to Move Fast – Once you are the successful bidder, you will be expected to pay for the property in full.

- Don’t Give Up – Just because you don’t win the first auction you attend doesn’t mean you can’t find a great deal. Keep attending auctions and eventually, you will be successful.

Wrapping Up

Purchasing a foreclosed home at auction can be a great way to get a bargain price on a property.

If you do your research and are prepared for the potential challenges, then you could end up with a great deal on a property.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.