When you’re looking for a new place to live, one of the most important factors to consider is how much rent you’ll be paying each month.

But what if you’re thinking about renting out a room in your house? How much should you charge roommates?

In this guide, we will provide tips and advice to answer the question: how much rent should I charge for a room? Keep reading to learn more!

What Is the Average Rent Price for a Room in Your Area

To start, you’ll need to do a little research to find out what the average rent price is for a room in your area.

This will give you a baseline to work from as you determine your own rent price.

You can use websites like Zillow, Redfin, or Apartments.com to search for rentals in your area and get an idea of what the going rate is.

What Does Your Room Have to Offer

Once you have an idea of the average rent prices in your area, it’s time to start thinking about how much you want to charge for rent.

You will first want to take a look at the size of the room. If it’s on the larger side, you may be able to charge more for rent. If it’s on the smaller side, you may want to charge less.

Next what amenities does your room come with? A private bathroom? A kitchenette? A walk-in closet? The more amenities your room has, the higher you can charge for rent.

Then you will want to consider your location. Is your house located in a desirable area? If so, you can probably charge more for rent.

But if your house is located in a less desirable area, you’ll likely have to charge less. In the end, it is really up to you how much rent you want to charge.

Tactic for Success

Use an online site to collect deposits, rent and any other payments. This can help you stay organized and on top of things. You can automatically schedule payments and send reminders to your tenants. You can also track payments giving both you and your tenants peace of mind.

Consider Your Household Expenses

Before deciding on a rental price, it’s also important to think about your own household expenses. How much are things like mortgage payments or property taxes?

Are you including wifi, electricity and water in the rent price? If so you’ll need to take into account how much those cost on a monthly basis and how much it will increase with someone else living there.

Additionally, if you have any debts or other monthly expenses like HOA or insurance, be sure to factor those in as well. These can vary whether you have a condo, townhouse, or duplex.

Your rental price should also give you a buffer for any unexpected expenses that may come up, like repairs or maintenance.

Knowing how much it costs to maintain your property will help you determine how much you should realistically charge for rent.

Trend on the Rise

Include all utilities, internet, and other monthly expenses in the rent price when renting a room. As the cost of living continues to rise, more and more people are looking for ways to simplify their budgets. Also, including all monthly expenses in the rent price can help to simplify accounting and record-keeping for both landlords and tenants.

Setting a Rent Price

When setting a rent price for a room, there are a few things to keep in mind.

First, be sure to consider the factors discussed above, such as the size of the room and the amenities it includes.

You will want to be competitive, if you’re charging more than the average rent price in your area, you’ll need to be able to justify it so people won’t think it’s a waste.

Are your rooms larger or more amenity-filled than other rentals?

You’ll also want to be aware of your market and what potential renters are looking for. If you’re targeting college students, they may not want to spend as much.

But if you’re targeting young professionals, they may be willing to pay more for a nicer room, and you can even market specifically to mobile professionals looking for apartments in a new area.

Additionally be flexible If you’re having trouble finding a renter, you may need to lower your price in order to attract someone.

Conversely, if you’re getting a lot of interest, you may be able to raise your rent price.

Finally once you’ve found a renter and agreed on a rent price, be sure to get everything in writing. This will help protect both you and the renter in case there are any problems later on.

This safety precaution is applicable to any type of rental agreement, whether you are renting out a single room, a house, or through Section 8 arbitrage.

Tactic for Success

Utilize the 1% rule. This rule of thumb suggests that you should charge one percent of your home’s value in rent. For example, if your home is worth $200,000, you should charge $2000 per month in rent for the entire place. Having that number can give you a good starting point but it is just a guideline.

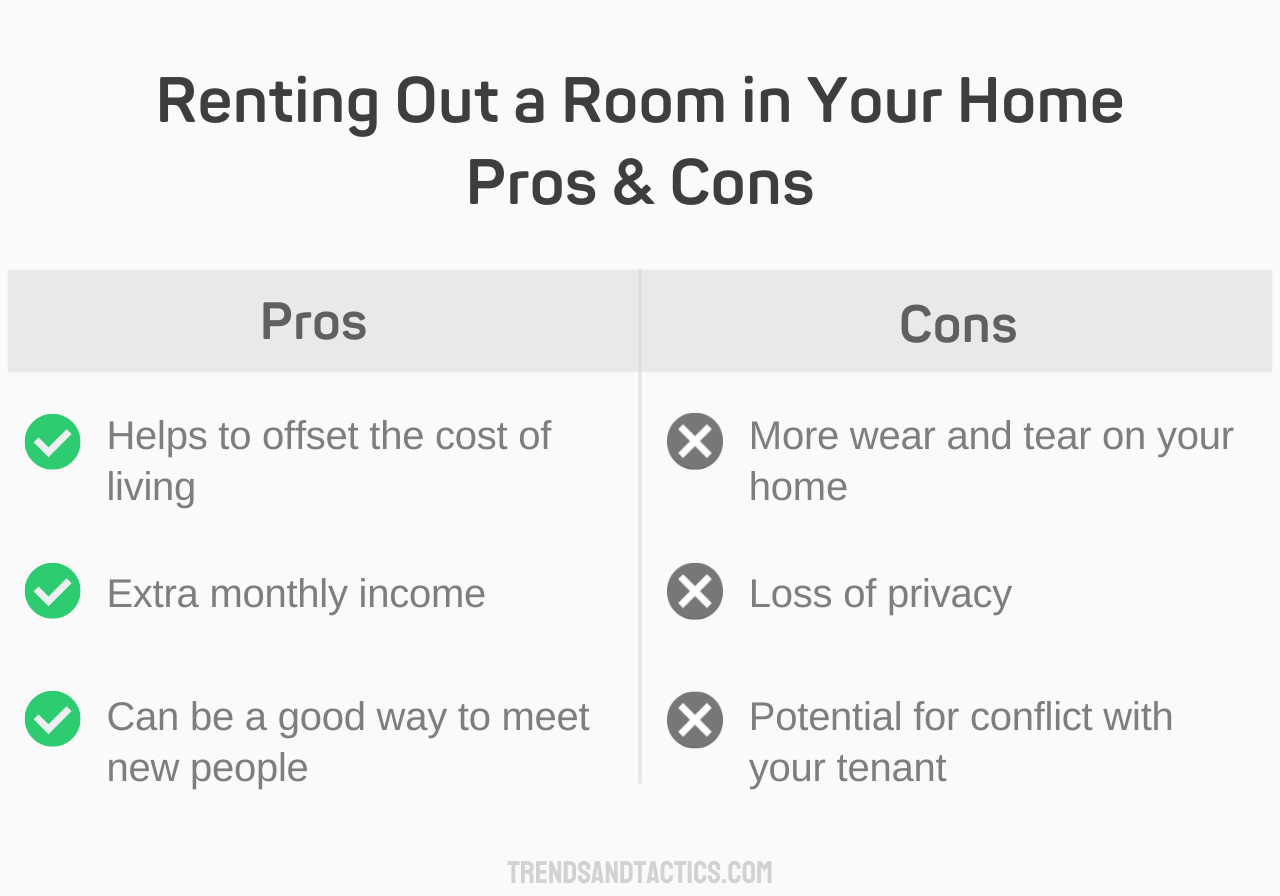

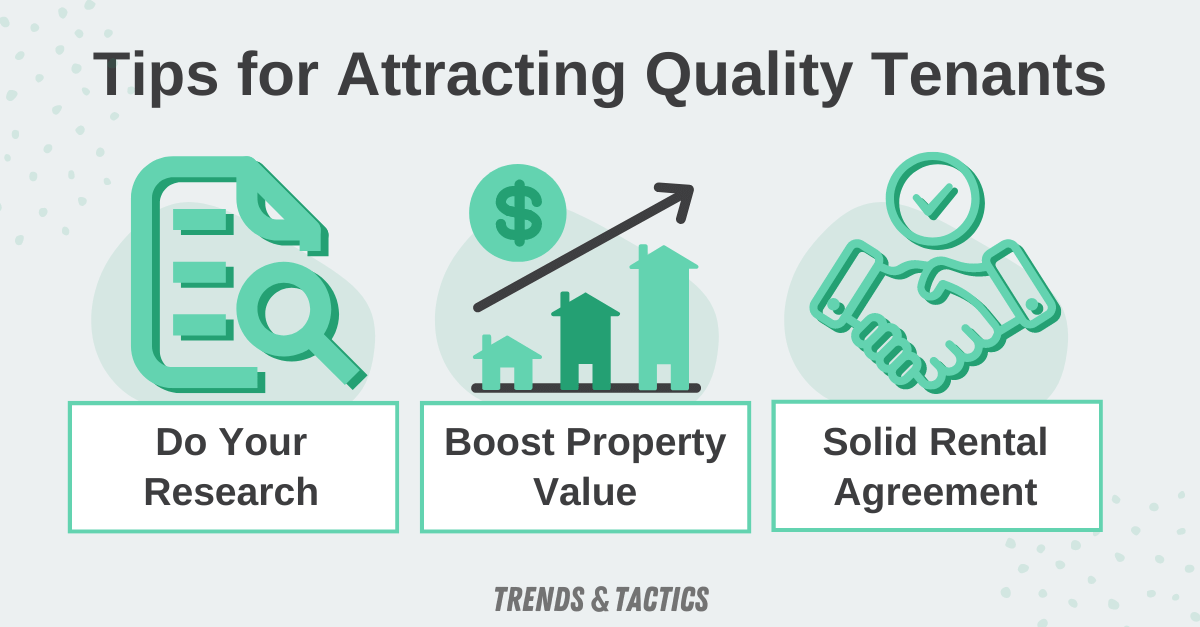

Tips for Attracting Quality Tenants:

- Make a good first impression – This can start with responding quickly to inquiries and having a well-written rental listing.

- Do your research – Screen potential tenants by doing a background check and asking for references.

- Be clear about your expectations – Set ground rules from the start so there are no surprises later on.

- Boost property value – Take care of your property and make any necessary repairs or updates. This will help attract quality tenants who are willing to pay a higher rent price.

- Have a solid rental agreement in place – This will protect both you and your tenant in case there are any problems down the road.

- Show your room to potential tenants in person – This will give you a chance to answer any questions they may have and help you determine if they are a good fit.

Wrapping Up

Once you’ve considered all of these factors, you should have a good idea of how much to charge for rent.

Just remember, the goal is to find a balance between what’s fair for both you and your potential tenants.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.