Minds are on money more than ever before.

Most Americans are still recovering from the financial gut-punch delivered by the pandemic, and want to make smart money decisions this year.

Some experts recommend tucking 10% of your money into your savings, while others disagree and say that’s nowhere near enough to retire on.

Instead of dancing these weird and outdated moves, here are the best modern ways of how to get rich.

Classic Business, But With A Twist

Consider starting a physical store that’s unlike the usual approach. If you can create an experience that people feel like they’ve missed out on, that can spark a lot of business and interest.

Some general things people say they’ve missed are:

- Sports

- Hitting the beach

- Concerts

- Date nights

- Movie theatres

- Weddings

- Big parties

Although nobody is asking for a sports bar karaoke wedding concert, you can riff on things that are already crowd favourites.

Think about what you could have used in the world during 2020, and how it could help people slip back into their daily lives. Cashing in on it isn’t a bad thing!

Avoid Working For Other’s Dreams

Working for other peoples’ dreams is how most people make money. Consider how much time and effort you’re putting into helping make someone else wealthy, and whether you’re getting the financial payout you deserve.

If not, you can change things to turn that around. Working for yourself doesn’t mean you have to start an LLC immediately or invent a new never-before-seen product. Most people break the ice with small ventures such as selling clothes online or flipping stuff on eBay.

Nearly 74% of businesses are self-owned by small entrepreneurs. This may sound like serious competition, but most fail in their first year. A sole proprietorship can be anything from writing kalimba songs on the internet to running a restaurant.

There are plenty of perks, including the following:

- Complete control

- Lack of set wage

- Simpler taxes

- Stepping stone to incorporation

- Ability to earn over 100,000 dollars a month from profit

Rent Out Spaces For Unconventional Uses

Don’t allow yourself to settle for less than your earning potential. If you have an office space, and you know you can only make $2,000 a month if you lease it to one business, rethink this plan.

More people work from home than ever before, with 41% of the workforce currently working from their residence.

Fortunately, because of vaccines and social distancing, people are getting back out there more, despite many jobs transitioning to 100% remote.

Instead of renting your office space to one company for $2,000 a month, you could quickly put in ten desks and five long tables and rent the same ample space out to several individuals with a monthly membership of $300 per reserved desk and $150 for a seat at one of the co-working tables.

This is how to get rich over time, without needing major structural upgrades.

People are desperate to get out of their homes and work amongst each other again. We’re social creatures, and it’s natural for us to want to be able to mingle like we used to.

As long as you follow CDC guidelines, you can ensure that you give them a safe and social place to work: while you turn a fantastic profit.

Create Passive Income

Nobody should have to wear themselves thin to be able to make some money. Instead of actively earning every penny of your money by putting out new work at all times, consider looking into ways to earn passive income.

Passive income allows itself to build and grow, selling itself and making more money for you without you ever having to lay a hand on a project after some initial work.

The most common example of this is through design resale sites. These websites like RedBubble or Zazzle allow you to upload a design, and they take care of the rest.

Other options that keep customers interested in buying into your passive income are:

- eBooks are specific to your expertise.

- YouTube commentary channel.

- Join Amazon Affiliate program

- Create a blog and host advertisements.

- Rent out a property that you don’t need to live or work in.

- Off unique insight or products through a monthly Patreon

Let People Pay You Monthly

The YouTube bubble has burst, and it’s almost impossible to make it big on that site anymore unless you’ve already been trying for at least five or six years and know how to get rich from nothing.

Instead, people are turning to websites like Patreon to allow them to make a monthly income. These monthly subscription sites encourage people to pay at least one dollar a month to see what posts their favourite creators are making.

More and more people are using this as a fun second job, to grow their overall income. But others, like user Sakimichan, have hit it big.

Before her numbers were hidden in 2015, this artist was making over $70,000 a month, and since then, her platform has only grown in size. She knows how to get rich, and for her, it’s as easy as doodling.

If you have a unique skill, and people are either curious about it or want to learn how you do it, you can make a Patreon and make money. Those one dollar a month subscriptions can add up into a real income.

Always Make Educated Investments

Oftentimes the first step to successful investment involves committed education towards the opportunity.

You don’t need to start buying into NFTs or trying to gather Dogecoin, but you should pay attention to current trends and figure out what works for you.

If you’re making big money decisions for the first time, pass them through a financial counselor or professional who has proven success. You may think that you know enough to get away with it, but educated investments improve your chances of walking away with loaded pockets.

This doesn’t just mean on the stock market, either. Suppose you prefer real estate and flip home for far more than it cost when you purchased it. Of course, flipping is not easy and is a learned skill, but people are making it work.

If you’ve never worked on a home before, set aside six months to a year to learn the craft from someone you respect.

An investment in yourself is never in bad faith; it’ll give you the chance to learn how to get rich from nothing by putting in committed effort over time.

Invest In Your Education

Although many may assume that by this, I mean you should get a fancy degree at a college nobody has been able to afford for the last twenty years so you can learn how to get rich from nothing: that’s not quite it.

Instead, focus on the act of understanding alone. You can, of course, get a bachelor’s in business if you study the correct techniques, but you should focus on methods that will help you learn how to invest.

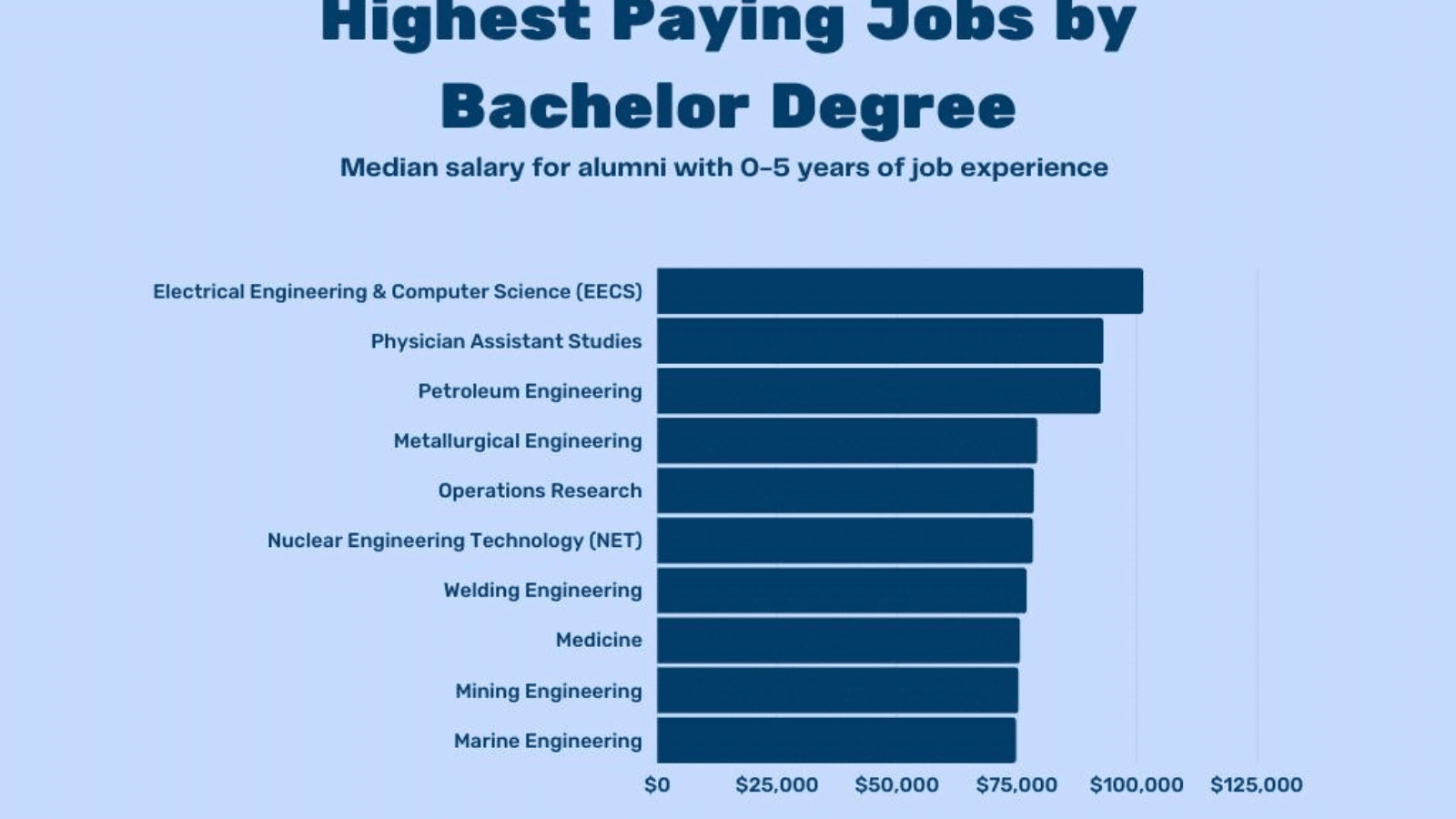

If you want an education that will guarantee money nearly any time, an engineering course can push you into six figures without having to break a sweat. Not every degree will make you money, though, so it’s vital to go in with a plan.

If you don’t want a degree, set up a goal to learn everything you need to start your own business, and then do it! You can take almost any college course online, and heavily solo-studied notes can rival study hours at school by a long raise.

Invest In Companies for Dividends

Dividends used to be discussed a lot more, but they’ve been swept under the rug lately and forgotten about. These potential earnings can add up, and with an investment of your own, they can give you extra income in the long term.

These great stacks of cash you can earn monthly are a return that companies give large investors to thank them for the faith put into the company. It’s better to start early with a small tech company so that you can build up a relationship together over time.

Most companies take pride in paying dividends to their shareholders, and in some cases have been doing so consistently 100+ years – such as Coca Cola, PPG Industries, and General Mills!

To invest for dividends, you should follow these steps with the help of a broker:

- Research companies with stock options that you’re interested in.

- Try to find high-return stocks that aren’t too volatile.

- Purchase the stock either through a broker or directly with the company. Using a broker means you have someone on your side if something should go wrong with the deal.

- Reinvest your dividends. Although you might be excited to gain your $3,000 a month and get to spend it on monthly bills, if you reinvest it, it will stretch further.

Invent Solutions To Modern Problems

Because of the virus, people had to get creative to produce and sell items more efficiently. Inventive and quick people were smart enough to set up medical mask vending machines used in airports, malls, or other public areas.

Others started up brand new drive-in theatres despite the need for them dwindling before 2020 struck.

Think about what you find yourself needing when you go outside and what would make your time at home more comfortable. If you’re not sure what speaks to you, you can always buy a patent from an inventor and sell it again for a higher price!

Have Multiple Streams of Income

If you only have one stream of income, you’re missing out on everything else out there that could be making you money.

There are 8 main types of payments:

- Active and passive

- Diversification

- Earned Income

- Profit Income

- Interest Income

- Dividend Income

- Rental Income

- Capital Gains Income

You can mix and match to pick which types of income work best to get rich your way, but the main focus to remember is that there needs to be more than one source.

Suppose you’re making passive income from an Amazon Kindle e-book. In that case, you should also work on getting interest income off of any songs you have and diversification, which is riskier but offers an enormous payout opportunity.

The NFT Art Phenomena

Although the impact NFTs have on the environment is debatable, the amount of money poured into these digital files is incredible.

The original concept for these was for them to be treated like collectors’ cards, but many see it as a status item showing they know how to get rich instead.

If you’re capable of creating art, or you can commission an artist to create something that they agree you can make into an NFT, you have what it takes to get into the NFT space.

NFTs are one of the most talked about methods of crypto investing since strategies like crypto arbitrage came about.

Although many sites are vague, setting up and selling NFTs follows this general process:

- Have digital art that’s unique, good-looking, and someone will want to buy. Don’t steal or use copyrighted work, or you could be setting yourself up for a very rough lawsuit.

- Add money to a digital wallet, choosing from popular companies like Coinbase or OpenSea. This will allow you to also purchase any you like, so you don’t get beaten to buying.

- Use a site like Rarible to upload and host your art.

- Pay the gas fee to list Your art.

- Advertise like wild on sites like Twitter and Instagram.

- When you sell, move to translate the money from your digital wallet into cash so that you can spend it!

Conclusion

There’s nothing wrong with having to take the time to get yourself back on your feet financially.

The fortunate thing is, there are a lot of people waiting on something to buy. With a bit of work and some clever thinking, you could give them exactly what they want while keeping your wallet well fed.

Top 15 Best Jobs that Pay 300K a Year in 2023

We list the top 15 best jobs that pay 300K a year in 2023. Top 15 Best Jobs that Pay 300K a Year

Top 15 Navy Jobs Making Waves in Paychecks and Demand

Here are the Top 15 Navy Jobs Making Waves in Paychecks with High Demand

Pitfalls and Warnings: Avoiding Costly Mistakes When Purchasing Your Tiny Home

We share the hacks to ensure you avoid costly mistakes when purchasing your tiny home. Pitfalls and Warnings: Avoiding Costly Mistakes When Purchasing Your Tiny Home

Erin is a business teacher and mother of three. When she’s not in the classroom or fulfilling her obligations as an A+ hockey and lacrosse mom, she’s working on her latest article.