Rental properties can be a great way to generate income, and they can also be a great way to build wealth over time.

In this guide, we will discuss how to make money with rental properties. We will cover everything needed to make money with rentals from finding the right property, to managing it effectively.

So, whether you are just getting started or you are looking for ways to improve your current strategy, this guide has something for you!

Appreciation

Investing in rental properties is a great asset since historically real estate prices have increased over time.

This appreciation can provide a significant return on investment, making rental properties an attractive option for those looking to make money in real estate.

For example, let’s say you purchase a rental property for $200,000. After 10 years, the property is worth $300,000.

If you sell the property at that point, you will have made a 50% return on your investment. If you do this with multiple houses over time, this could potentially become a millionaire job.

Not every home will appreciate at the same rate, but over time, real estate has consistently gone up in value.

This makes rental properties a safer investment for those looking to make money in the long term.

If you are looking to buy your first rental property, check out these tips on how to save money for a house in 6 months.

It is important to do research on the location before investing in rental property for beginners because some areas are more likely to appreciate than others.

It will be difficult to make money if the property is not in a desirable location.

For example, properties located in areas with good schools, public transportation, and amenities will be more likely to appreciate than those located in less desirable areas.

While appreciation is a great way to make money with rental properties, it is not the only way.

Vacation Rental

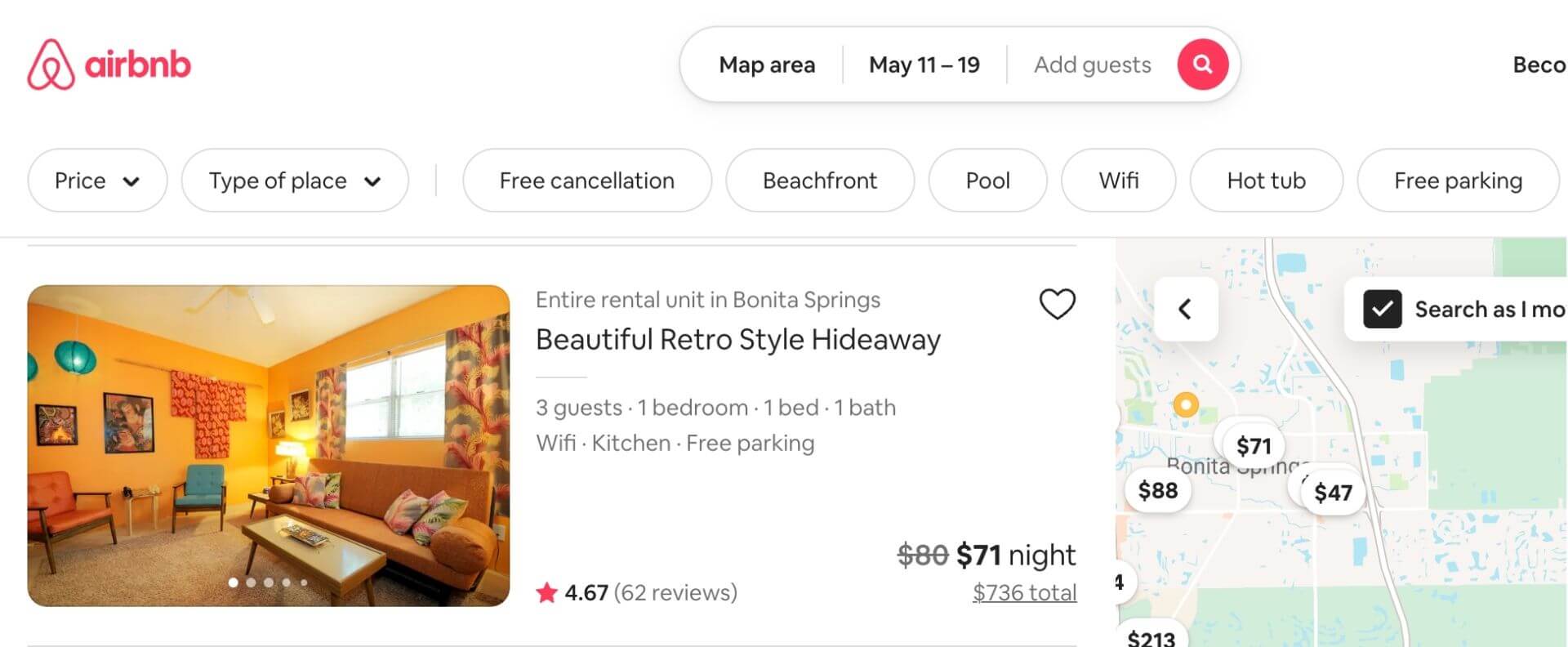

A vacation rental is a furnished home, condo, or villa that you can rent for a short period of time. These rentals are generally available by the day, week, or month.

The vacation rental industry is anticipated to potentially collapse the hotel industry. They offer travelers a more home-like experience than a traditional hotel and often come at a fraction of the cost.

Even farmers make money this way by renting out bed and breakfasts with a unique and quaint vibe.

Vacation rentals can be a great way to maximize your earnings, as you can charge higher rates for shorter stays.

But you will have to fully furnish the property and stock it with amenities like kitchenware, linens, and towels. You will also need to clean the property between each guest.

It’s important to remember that your vacation rental won’t be rented out every day of the year.

There will be days when the property is unoccupied, and you’ll need to cover the cost of utilities, maintenance, and other expenses.

A hospitality or business degree would be two of the best degrees to earn money in the vacation rental industry, but is definitely not required.

Best Places For Vacation Rentals Properties:

- Near a Beach – People love to vacation near the water, so beach rentals are always in high demand.

- In the Mountains – If your rental is located in a popular ski destination, you can command high rates during the winter months.

- In a Big City – Rentals in major metropolitan areas are always in high demand.

- On a Lake – Vacationers often want to spend time on the water, so lakefront rentals can be a great option.

- In the Country – If you have a rental in a rural area, you may be able to attract guests who are looking for a quiet getaway, especially if you are close to a major city.

- Near a Large College – College towns can be a great place to rent out a property, as there is always a demand for housing during the school year, especially if the school has a big sports team. This can be a great way to make money while in medical school or college if you own property nearby.

- Near Theme Park – Theme parks are typically year-round attractions making them a great option for vacation rental properties.

Trend on the Rise

A new trend is on the rise where people are creating themed vacation rentals that look like your favorite TV show, movie, sports team, and more. This is a great way to attract guests who are looking for a unique experience. You can even include props and memorabilia to make the experience more authentic.

Annual Rental

An annual rental is a property that is leased for 12 months. There are quite a few benefits to renting investment property annually.

The main advantage is that it is a steady income stream. You can count on receiving the same amount of rent every month, which can be helpful when budgeting and planning.

Another benefit of renting a property annually is that it can be easier to find tenants since the majority of people are looking for 12-month leases.

Additionally, as a property owner, you’re entitled to certain tax deductions. These can help offset the costs of maintaining your rental property, and they may even help you turn a profit.

Some of the most common deductions include repairs and maintenance, property taxes, and insurance.

You can also deduct any interest you pay on a mortgage or home equity loan used to finance your rental property.

Tactic for Success

As a rental property owner, you are always looking for ways to minimize costs and maximize profits. One of the best ways to do this is to minimize tenant turnover. You can do this by keeping your tenants happy. If they have a maintenance issue or concern, address it quickly. By showing that you care about your tenants’ experience, you can encourage them to stick around for the long term.

Accessory Dwelling Unit

An accessory dwelling unit (ADU) is a secondary dwelling unit on a property that is typically used as additional living space for a family member or as rental income.

An ADU can be attached to the main house (such as a garage conversion or basement apartment) or it can be a standalone unit (such as a guest house or granny flat). In some cases, ADUs are even built above garages.

In recent years, there has been an increasing interest in ADUs as a way to increase the density of existing neighborhoods, provide more affordable housing options and provide additional income to homeowners.

Adding ADUs To Your Property

If you’re considering adding an ADU to your property, there are a few things you need to know.

First, you’ll need to check with your local zoning ordinances to see if ADUs are allowed in your area.

In some cases, you may need to obtain a special permit. Second, you’ll need to design and build the unit according to local building codes.

If you already have a home building an ADU can be a great way to generate additional income.

While there are some upfront costs associated with building an ADU they are considerably less than buying an investment property.

And some companies specialize in prefab homes that can be delivered right to your property. Like a shipping container that is already outfitted with everything from kitchens to bedrooms to bathrooms.

In addition, building an ADU can add value to your existing property, making it a smart investment for the future.

Trend on the Rise

In recent years, there has been a growing movement in support of tiny houses. Proponents of this lifestyle argue that it is more sustainable and efficient than traditional forms of housing. As the movement continues to gain momentum, more and more people are beginning to reconsider what they need in a home. For many, the answer is less than they originally thought.

Reinvest In More Rental Properties

Investing in rental properties can be a great way to build wealth over time. By reinvesting the profits from your rentals back into buying more properties, you can greatly accelerate your growth.

This strategy is often referred to as “house hacking.” The key to success with this approach is to carefully track your expenses and focus on acquiring properties that will generate positive cash flow.

With careful planning and execution, house hacking can be an effective way to build a large portfolio of rental properties and create lasting financial security.

Hiring A Property Manager

Having one rental property can require a lot of time. Having multiple can be a full-time job.

Between screening and signing leases, collecting rent, addressing repair issues, and dealing with problem tenants, there’s a lot to stay on top of.

Hiring a property manager is a great way to take your time back.

A good property manager will take care of all the day-to-day tasks of running your rental property, so you can enjoy the benefits of being a landlord without the headaches.

A property manager will:

- Set Right Rental Rate – Will do market research to maximize monthly income while maintaining a low vacancy rate.

- Rent Collection Efficiency – Collects rent and handles any late payments.

- Lists Your Property – Will market and advertise your property to get tenants.

- Finds The Right Tenants – Will run background checks, and credit reports, verify employment, and get references.

- Manage Tenants – Will handle routine and emergency maintenance. Routine inspections and manage any situation where conflict may arise.

- In Compliance With Property Laws – Will keep your property in compliance with local, state, and federal regulations.

- Allow You To Invest Anywhere – This allows you to invest anywhere since you won’t have to be around to manage properties.

Tactic for Success

By leveraging the equity in your home, you can free up cash to buy additional properties. Some ways to do this include taking out a Home Equity Line of Credit (HELOC) or Cash-Out Refinance. This can then be used for down payments or renovations on new properties.

Wrapping Up

It’s important to remember that making money with rental properties is not just about buying as many properties as you can.

It’s also about finding the right properties, in the right locations, and ensuring that they are well-maintained so you can maximize your profits.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.