Buying a house is one of the biggest decisions you will ever make in your life.

Not only is it a large financial investment, but it’s also a huge emotional one. So, what is the cheapest month to buy a house?

While there are many factors to consider, with the market constantly changing, these tips will help you decide when is the best time to buy a house in 2022.

Is Now Still a Good Time to Buy a Home?

There is no doubt that the housing market has been on a roller coaster ride over the past few years, leaving many people wondering how to get a property in today’s market.

After seeing prices skyrocket during the real estate boom of the early 2000s, many homeowners were left devastated when the market came crashing down.

With the intense rise in prices over the last 2 years, there has been a great deal of skepticism about whether or not is now a good time to buy a home, in fear that prices may soon come crashing down again.

Housing Supply Low

The reality is that no one can predict the future of the housing market with 100% accuracy. However, there are several factors that suggest that now is still a good time to enter the housing market.

For one thing, the supply of homes remains relatively low, while the demand continues to increase, making more investors buy homes without inspections to stay competitive.

This imbalance is due in part to the fact that there has been very little new construction over the past decade. With more and more Millennials buying houses and Gen Z’s soon entering the home-buying market, it is likely that demand will continue to outpace supply.

This means that prices are likely to continue to increase. Another factor to consider is that mortgage rates are still relatively low by historical standards.

Although they have been on the rise lately, they are still below the levels seen during the last housing boom.

This makes now a good time to lock in a low interest rate and you can always refinance if rates drop in the future. If you choose to sell, you can also use some of these other ways to sell your house in this hot market.

The Best Time to Buy a House Is Typically in the Winter

Many people believe that the best time to buy a house is in the spring, when the weather is good and there are more houses on the market.

However, there are actually several advantages to buying a house in winter. For one thing, prices tend to be lower during this time of year as there are less buyers wanting to move around the holidays.

Additionally, you will have more negotiating power as sellers don’t want their house to get stagnate on the market and are more likely to accept a lower offer.

If you think renting is a waste, this could be the time to get a better deal on your new home.

The Cheapest Month to Buy a House Is Typically December

When it comes to buying a house, timing is everything.

Prices can fluctuate significantly from month to month, and buyers who are looking for a bargain can often find one by paying close attention to the housing market.

In general, the cheapest month to buy a house is typically December. This is because many people are busy with holidays and other commitments and don’t have time to house hunt.

Alternatively, the holiday season can be one of the top times to make passive money on Airbnb. As a result, there are often fewer buyers in the market, giving sellers an incentive to lower their prices.

Rise In Interest Rates

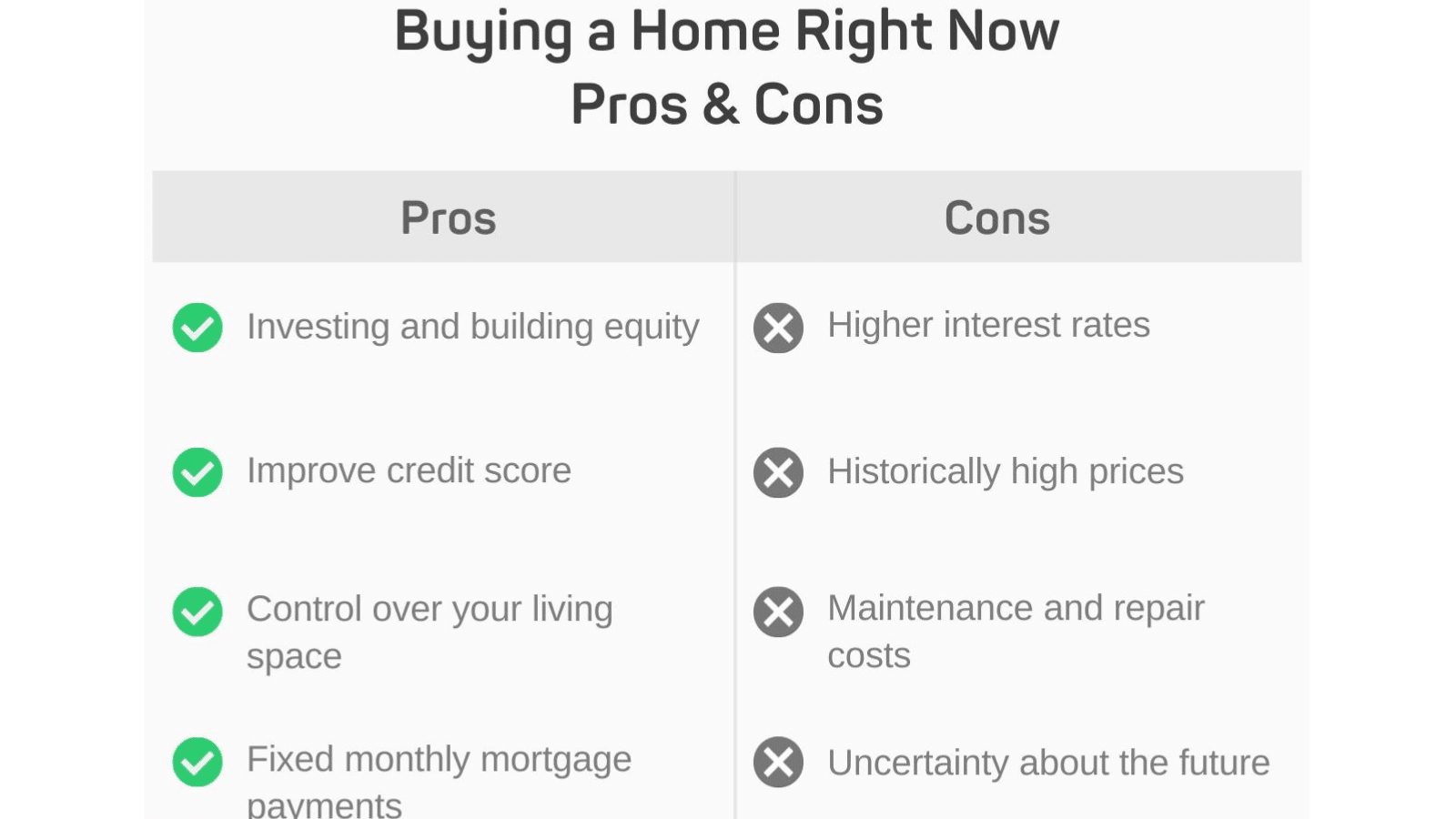

Mortgage rates have been on the rise for the past few months, and they are likely to continue to climb throughout the rest of the year.

This is largely due to concerns about inflation, and the possibility of a recession which has been coming up lately.

With the increase in home prices and the rise in interest rates, affordability has become an issue for many buyers and has slowed down home sales.

However, sellers are also starting to adjust their expectations, and many are now more willing to negotiate on price.

This means that although we are still in a sellers market, there may be opportunities for buyers to get a good deal on a home.

Days On Market Trend

For those looking to buy a house in 2022, paying attention to the days on market (DOM) may be a wise move.

DOM is a lead measure for seeing change in pricing, which means that as DOM goes up, prices typically come down and vice versa.

In a sellers market, which we are currently in, the majority of homes are going under contract within 7 days, often less. This is due to the lack of inventory in the marketplace.

So if DOM starts going up this is a good indication that prices may start coming down or there may be reduced prices. Types of Housing Markets:

- Buyer’s Market – Is when there is more than six months of inventory on the market. Giving buyers more negotiating power and can often get a home for under the asking price.

- Seller’s Market – Is when there is less than three months inventory on the market. This is a good time to sell as sellers often receive multiple offers and sell above asking price.

- Neutral Market – Is when there is between three to six months of inventory on the market. This is considered a fair market where buyers and sellers have somewhat equal negotiating power.

Tips for Buying a Home in 2023

Although the current housing market conditions are not ideal for buyers, there are still ways to get a good deal on your new home.

One of the most important things you can do is to be prepared to move quickly when you find a property you like. In many markets, homes are selling within days or even hours of being listed.

This means that you need to be ready to make an offer as soon as you find a property you like. Another tip to be flexible on terms.

If the seller isn’t budging on price, see if they’re willing to be more flexible on other terms – such as the closing date or the inclusion of certain appliances or fixtures.

Often, these types of concessions can make all the difference in getting a deal that works for both parties

Make sure to work with an experienced buyers agent. They can help you navigate the constantly changing market, negotiate on your behalf, and find properties that fit your needs and budget.

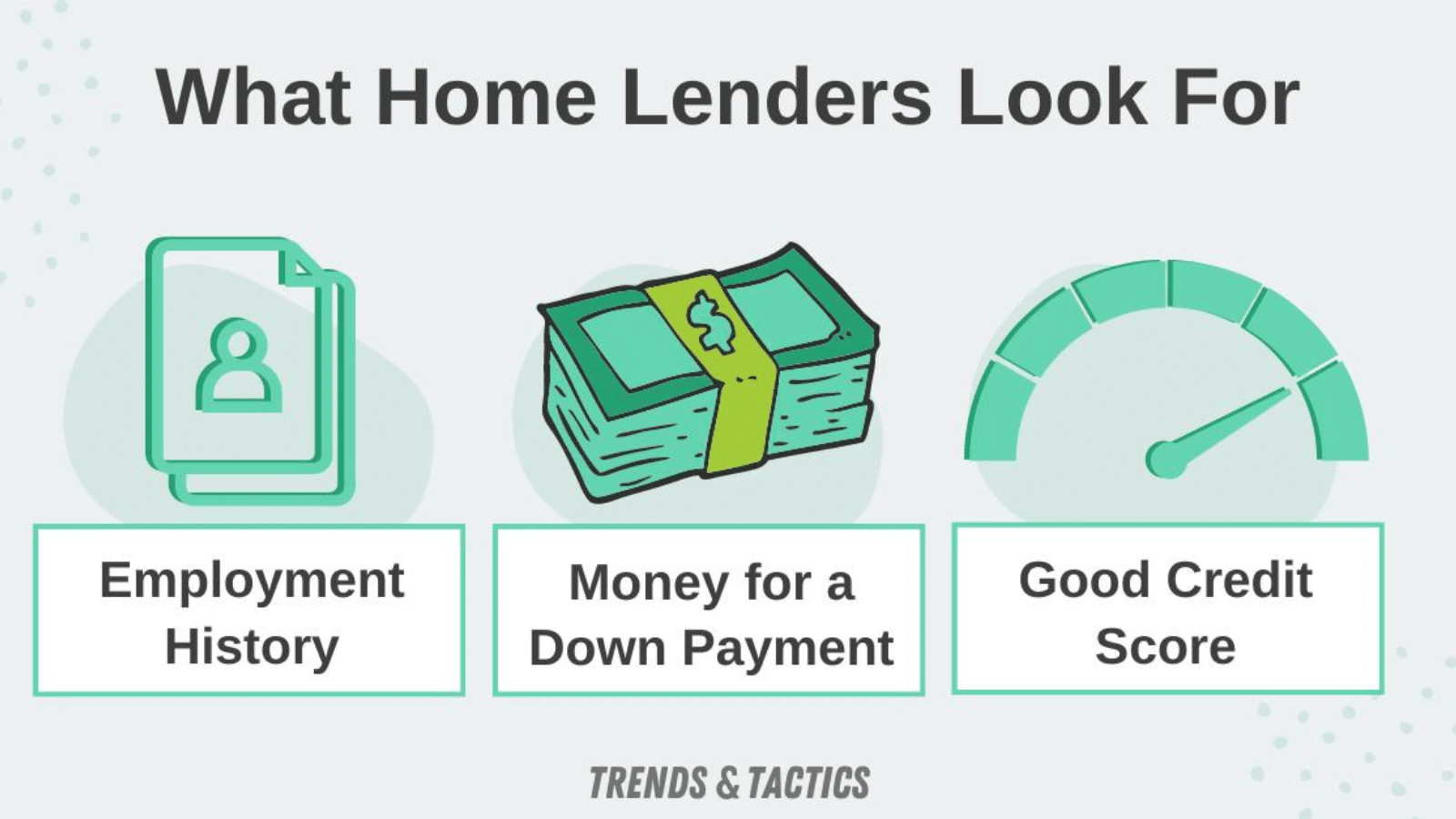

Things a Lender Looks at When You Are Buying a House:

- Stable Employment History – Mortgage lenders like to see stability in employment. They want to know that you have a steady income and are likely to continue to have a steady income.

- You Have Money for a Down Payment – In order to get a mortgage, you will need to have money for a down payment and closing costs.

- You Have a Good Credit Score – Your credit score is one of the most important factors that lenders will consider when you are applying for a mortgage.

- You Have a Handle on Your Debt – Lenders will look at your debt-to-income ratio and your credit utilization ratio to get an idea of how much debt you can afford to take on.

Wrapping Up

All in all, there is no way to say what is the perfect time to buy a house.

However, by paying attention to market trends and being aware of the seasonal fluctuations in prices, you can increase your chances of finding a great deal on your dream home.

Top 15 Best Jobs that Pay 300K a Year in 2023

We list the top 15 best jobs that pay 300K a year in 2023. Top 15 Best Jobs that Pay 300K a Year

Top 15 Navy Jobs Making Waves in Paychecks and Demand

Here are the Top 15 Navy Jobs Making Waves in Paychecks with High Demand

Pitfalls and Warnings: Avoiding Costly Mistakes When Purchasing Your Tiny Home

We share the hacks to ensure you avoid costly mistakes when purchasing your tiny home. Pitfalls and Warnings: Avoiding Costly Mistakes When Purchasing Your Tiny Home

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.