People often debate whether renting an apartment or house is a waste of money.

Some people insist that buying is always the best option and wonder why do people rent, while others maintain that renting is the only way to go.

But what’s the truth? Is renting a waste of money? Here’s a look at both sides of the argument.

The Cost of Renting Is Increasing Each Year

If you are not in a rent-controlled apartment or have a considerate landlord then you have to deal with rents increasing each year.

This is a burden for many people, especially those who are on a fixed income or have a low income. Some landlords work with Section 8 arbitrage, so this is a good option if you find yourself in a tough situation.

Landlords raise rents to keep up with the rising cost of property taxes, insurance, and maintenance.

Currently, rents are increasing across the country due to demand and inflation. If you are not able to keep up with the rising costs you can be priced out of your home.

Trend on the Rise

Put a tiny house on a friend or family member’s property. With the rise in rents and homeownership, people are finding that they can save money by living in a tiny house. There are many benefits to living in a tiny house, including the ability to save money on utilities and the freedom to live a more nomadic lifestyle.

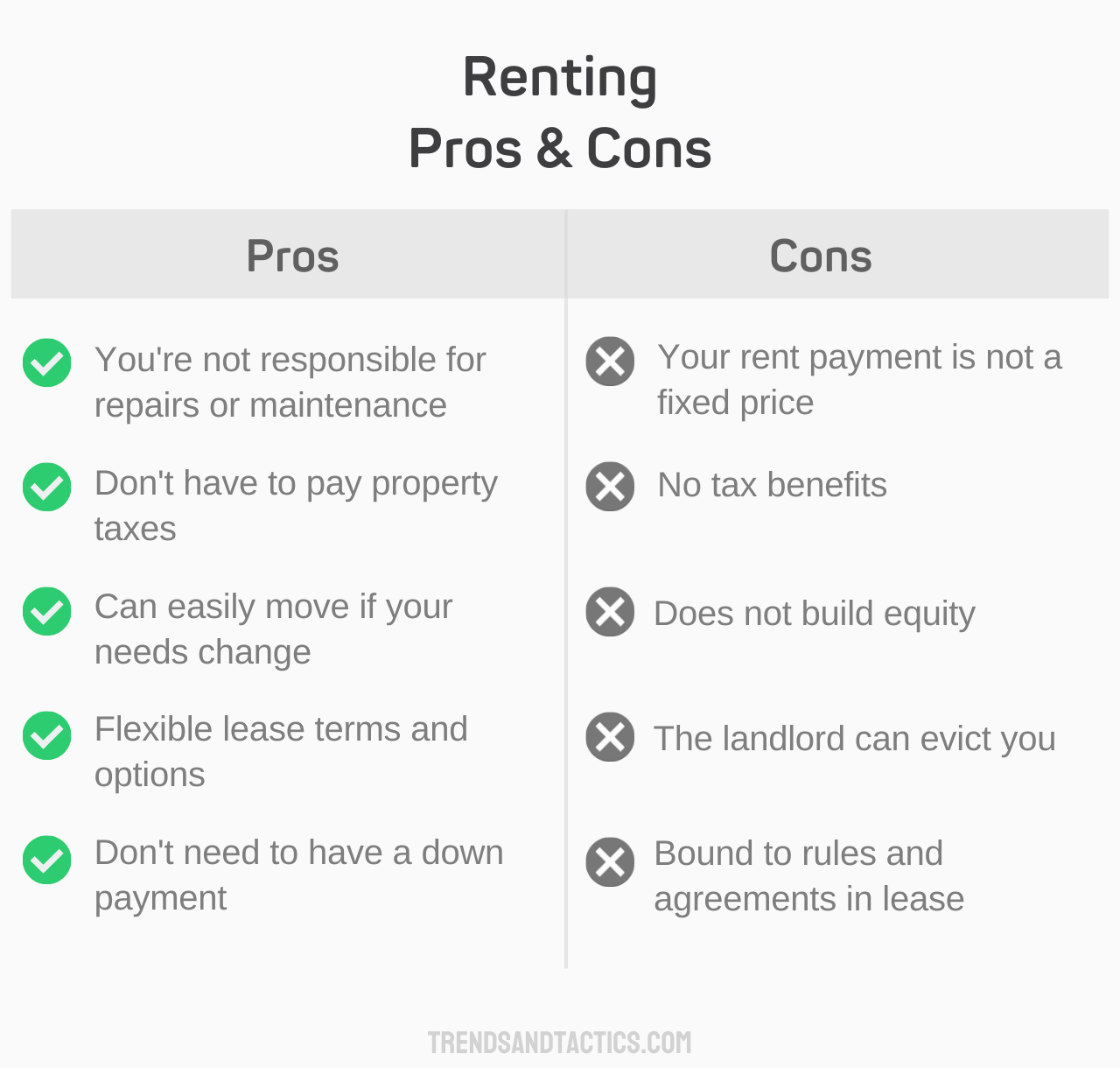

You Are Not Able to Build Equity in a Rental Property

While there are many pros and cons of renting, one of the biggest cons is when you rent a home or apartment, you are essentially paying someone else’s mortgage.

If you are wondering how much landlords make, this money comes directly from you as a renter.

While this has its perks it also means that you will never build any equity in the property.

Equity is the portion of your home’s value that you actually own; it increases as you pay down your mortgage and as the market value of your home goes up.

Unfortunately, since you do not own the rental property, you will never see any of that increase in value.

This can be a major downside for renters who are looking to build long-term wealth through real estate investment.

Trend on the Rise

Build wealth by setting up an automatic savings plan. Transfer money from your checking account into a dedicated savings or investment account weekly or monthly. The amount you are transferring should be realistic so you won’t put yourself in a position where you will need to dip into your savings in order to cover bills or other unexpected expenses.

Renting Does Not Provide Tax Benefits That Homeownership Does

For many people, the appeal of renting is that it doesn’t come with the same financial responsibilities as homeownership.

You don’t have to worry about maintaining the property or paying for repairs and upgrades.

All of that is taken care of by your landlord. However, one downside of renting is that you don’t receive any of the tax benefits that homeowners do.

Homeowners can deduct the interest they pay on their mortgage, as well as any property taxes they may owe.

They may then use this extra cash to invest in these inexpensive ways to increase home value.

This can result in significant savings come tax time. Renters, on the other hand, cannot deduct their rent from their taxes.

Tactic for Success

If you’re self-employed or an independent contractor, you can save on taxes by deducting home office expenses. This includes things like a portion of your rent or mortgage and utilities. Keep in mind that there are some restrictions on the home office deduction, so be sure to talk to a tax professional before claiming it.

Rent Can Be More Expensive Than Monthly Mortgage Payments

Depending on where you live, your monthly rent payment may be higher than what you would pay for a mortgage.

Right now there are many markets where renting a two-bedroom apartment can cost more than a monthly mortgage payment on a median-priced home, especially as more and more people learn how to earn money with Airbnb.

This is one of the biggest downsides of renting – you may be paying more each month than you would if you owned a home.

Tactic for Success

Find a low down payment program to make homeownership more affordable. The FHA offers a 3.5% down payment program and a minimum credit score of 580 for qualified buyers. There are also a number of down payment assistance programs available for first-time buyers and low-income buyers.

When does it make sense to stop renting and buy a home:

- Your Income Is Stable – To qualify for a mortgage, lenders will want to see that you have a stable job and income.

- You Have a Good Credit Score – A good credit score will increase your chances of being approved for a mortgage with a lower interest rate.

- You’re Tired of Throwing Money Away – If you feel like you’re just throwing money away each month on rent, you can build equity by buying a home.

- You Have Enough Saved for a Down Payment and Closing Costs – To buy a home, you’ll need a minimum of 3.5% down payment. You’ll also need to budget for closing costs, which can add up to several thousand dollars.

- Interest Rates Are Low – Interest rates play a big role in how much your mortgage payments will be each month. If interest rates are low, it might be a good time to buy.

- You’re Ready to Settle Down – If you’re tired of moving and you’re ready to settle down in one place, buying a home may be the right choice for you. If you change your mind, you can use these alternative ways to sell you house.

- You Want to Make Changes to Your Living Space – If you’re renting, you likely won’t be able to make any major changes to your living space. Once you own a home, you can make any changes you want.

When Renting You Know Exactly How Much Your Housing Costs Will Cost per Month

When you rent, you have peace of mind of knowing exactly how much your housing costs will be each month.

You can budget accordingly and don’t have to worry about being blindsided by a costly repair. This is one of the big appeals of renting for many people.

With homeownership, on the other hand, you never know when something might break or need to be replaced. This can lead to unexpected and costly repairs that can put a strain on your budget.

Benefits of Renting:

- You Don’t Have to Worry About Repairs or Maintenance – If something breaks, it’s up to your landlord to fix it. This can be a major advantage, especially if you live in an older home or apartment.

- You Have the Flexibility to Move – If you need to move for work or any other reason, it’s much easier when you’re renting. You can simply give your landlord notice and be on your way.

- Renting Can Be a Cheaper Option in Some Markets – Sometimes it is cheaper to rent than to buy. This is often the case in larger cities where the cost of living is high and housing prices are sky-rocketed.

- You Don’t Have to Stress if the Housing Market Crashes – If the housing market crashes and home prices drop, you’re not stuck with a property that’s worth less than what you paid for it.

- You Don’t Have to Pay for Property Taxes or Homeowners Insurance – When you’re a homeowner, you’re responsible for paying both property taxes and homeowners insurance. This can add hundreds of dollars to your monthly expenses.

- Can Give You Access to Amenities – Many rental properties offer access to amenities that you would not have if you owned your own home. This can include things like a swimming pool, gym, and clubhouse.

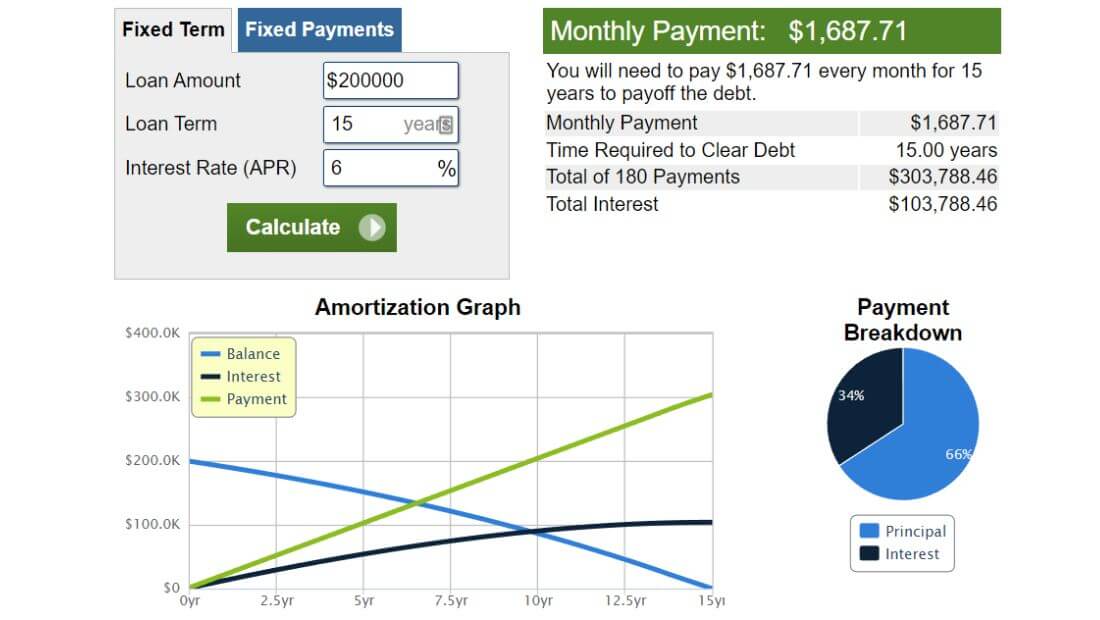

When You Buy a Majority of Your Mortgage Payments Are Going Towards Interest at First

When you buy a house, the vast majority of your mortgage payments for the first few years are interest.

This can be disheartening, especially when you remember the large sum of money you paid upfront in the form of a down payment and closing costs.

However, it’s important to remember that this is just how mortgages work.

The lender wants to make sure they are being paid back for the loan, with interest, so they front load the payments accordingly.

Of course, you’re also building up equity in your home with each payment but if you are not planning on staying for the long haul, it can be frustrating to see such a large chunk of your payment go towards interest and feel like a waste of money.

Wrapping Up

While there are advantages and disadvantages to renting, the truth is you are not wasting money if you are providing a home for yourself to live in.

Whether you rent or buy is completely up to you and what makes sense for you in your life.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.