If you’re looking for a unique investment opportunity, storage unit investing may be just what you’re looking for.

Self storage investing involves buying storage units and renting them out to tenants. This can be a great way to earn passive income and build long-term wealth.

However, there are a few things you need to know before getting started. Keep reading for our expert tips on storage unit investing for beginners.

What Is Storage Unit Investing and Why to Consider It

Storage unit investing is a form of real estate investing that involves purchasing storage units and renting them out to tenants, similar to making a short term rental business.

There are a number of reasons why storage unit investing can be a great way to make money.

For one, storage units are typically in high demand, as there is always a need for extra storage space.

Additionally, storage units can be rented out at relatively high prices, providing a steady stream of income.

Finally, storage unit investing is a relatively low-maintenance form of real estate investing, as the units do not require a lot of upkeep, making it easier than passive income with Airbnb.

Trend on the Rise

Storage pods delivered right to your door. These are becoming popular as an alternative to self-storage units. They are weather-resistant containers that can be delivered and picked up right to your home. Pods can be stored on your property or at a storage facility and best of all they can be shipped anywhere if you need to relocate.

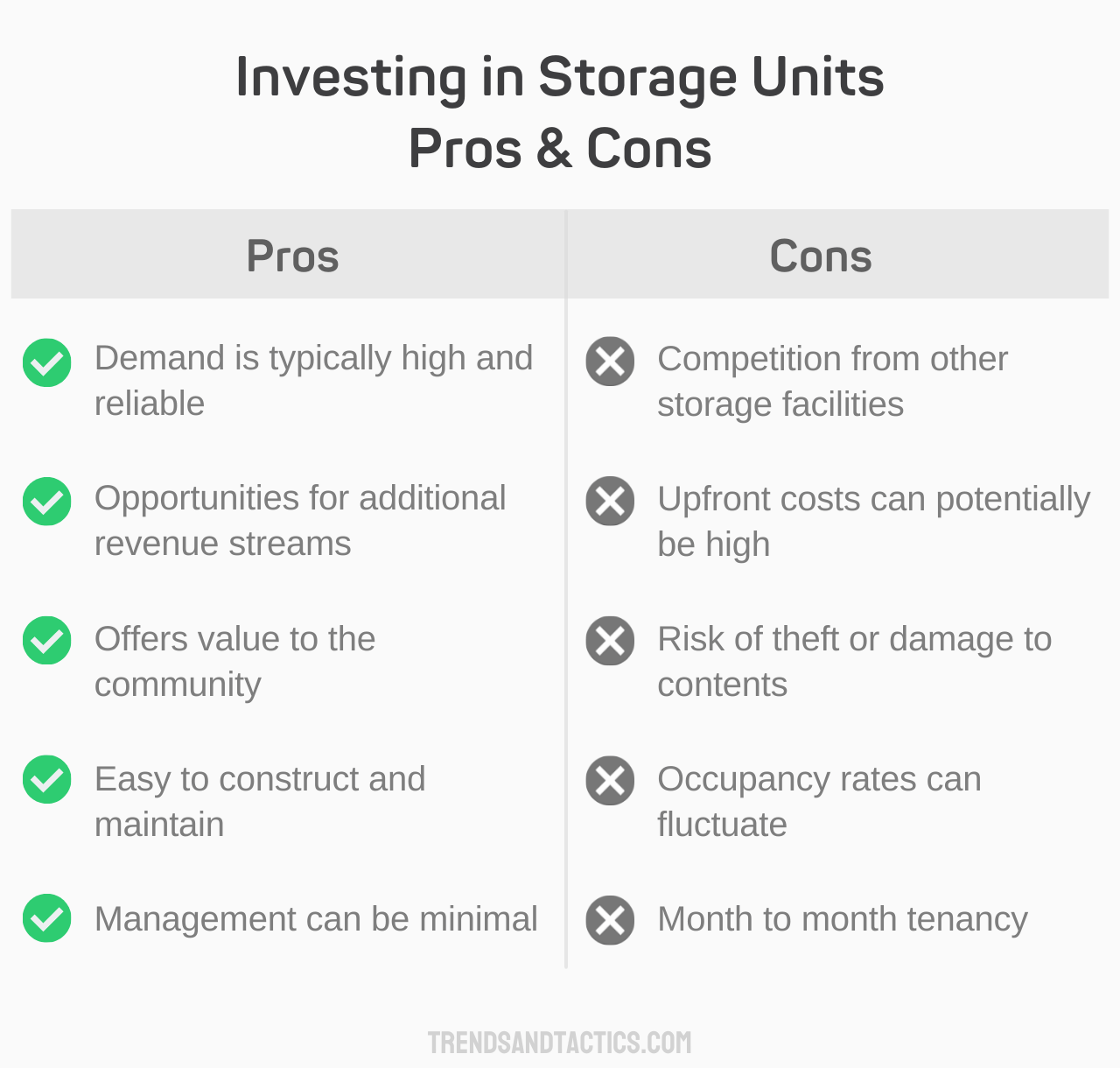

Of course there are pros and cons of owning storage units but if you are looking for an alternative way to make money through real estate, storage unit investing is an option worth considering.

What to Look for When Investing in a Storage Unit

There are a few key factors to consider when investing in a storage unit. First, you’ll want to look at the location of the unit. Is it in a high-traffic area?

A storage unit in a high-traffic area is more likely to be rented out and generate income than one in a less desirable location.

Many of the same factors you’ll need to consider when getting a home in today’s market.

Tactic for Success

Make sure you have a business profile on the search sites like google and yelp with reviews. These days most people will search online for storage units near me and you want to make sure they can find you. Offer incentives to current tenants in exchange for reviews. Reviews build trust with potential customers increasing their likelihood to choose you.

Additionally, you’ll want to consider the size of the units.

Larger units will typically be more expensive, but they can also provide more storage space for tenants, whereas smaller units may be less expensive but offer less storage space.

It is good to have a mix of both small and large units to appeal to a variety of tenants.

Finally, you’ll want to consider the amenities offered by the storage facility.

Storage units with climate control, security features, and other amenities will typically be more expensive than units without these features but they can also be more attractive to tenants.

When trying to figure out how much to charge for rent, you’ll want to consider all of these factors.

Keep in mind the average rent of a storage unit in 2021 was $1.16 per square foot this should give you a starting point

Types of Self Storage Facilities:

- Class A – Storage units that are new or recently built, and they offer the best in terms of security, climate control, and other amenities.

- Class B – Storage units are typically older, but they still offer a good level of security and climate control.

- Class C – These storage units are the oldest and least well-maintained, but they are usually the cheapest.

How to Fund Your Storage Unit Investment

When it comes to storage unit investing, one of the most important considerations is how to fund the investment.

There are several different ways. The right choice will depend on the individual investor’s circumstances.

One option is to use personal savings.

This can be a good choice for those who have a bit of money set aside and who are comfortable taking on risk, however using personal savings means that there is less money available for an emergency.

Another option is to take out a loan. For those with decent credit and a trust in their ability to make regular payments, this might be the way to go.

You can look into local regional banks, credit unions, SBA and even seller financing.

Working with a real estate agent can help you discover your best option, or you may prefer one of these alternative methods to sell real estate or buy it.

A third option is to partner with another investor.

This can be a good way to spread the risk and potentially increase returns by pooling resources, however it is important to choose a partner that you trust and who shares your vision for the investment.

Ultimately, the best way to fund a storage unit investment will vary from person to person, so it’s important to choose the option that makes the most sense for you and your circumstances.

Tactic for Success

The 7A Loan Program and 504 Lending Program are two federal programs that provide financing specifically for storage units. Both are available through the Small Business Administration (SBA). Both programs offer low-interest rates and long repayment terms, making them an ideal option for business owners looking to finance the purchase or construction of a storage unit.

How to Make a Profit From Your Investment

It is widely said that you should have 80%-90% occupancy to make a good profit from your storage unit.

This is not always the case as there are many other factors to consider such as location, prices, and amenities.

However, if you can maintain a high occupancy rate, you’re more likely to see a better return on your investment.

One way to increase occupancy is to offer discounts or promotions. For example, you could offer a discount for those who sign a long-term lease, or you could offer a free month of storage for referrals.

By offering discounts and promotions, you can attract more tenants and increase your chances of seeing a return on your investment.

Trend on the Rise

Investing in a real estate investment trust (REIT) instead of buying a storage facility. A REIT is an investment that allows you to pool your money with other investors to purchase a portfolio of income-producing real estate assets. Storage units can be held in a REIT and they tend to be less volatile than other types of real estate.

Additional Revenue Opportunities

Storage units can provide a great source of income on their own. However, there are additional ways to generate income from storage units that you may not have considered.

Truck rentals, for instance, can be a lucrative way to earn money from storage units.

By renting out trucks to customers who need to move large items, you can quickly generate a steady stream of income.

Similarly, selling boxes and packing materials can also be a great addition to your storage unit business.

By stocking boxes and other supplies, you can provide a valuable service to customers who are looking to pack up their belongings.

Unique Ideas

A unique idea is generating solar power. By installing solar panels on the roof of your storage units, you can produce renewable energy that can be sold back to the grid while decreasing your electric bill.

Another interesting way to diversify your business is to host pop-up shops in your storage unit facility.

By renting out space to small businesses, you can provide a valuable service and potentially earn a commission on sales.

There are many ways to generate income from storage units. With a little creativity and effort, you can quickly take a regular storage unit business and turn it into a thriving enterprise.

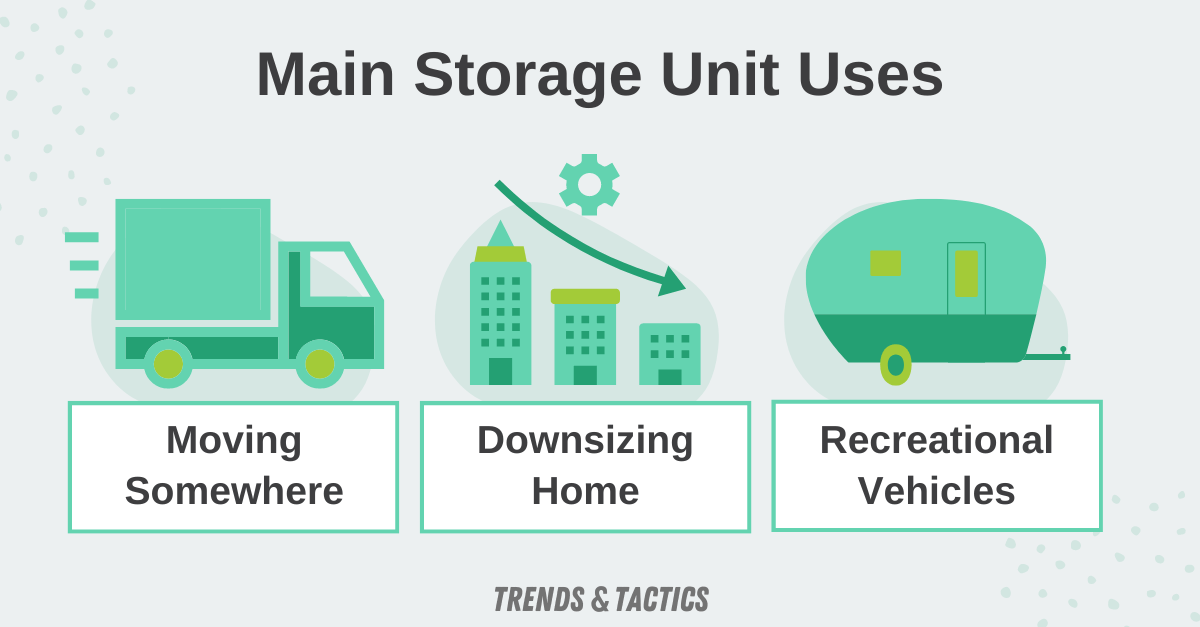

Main Reasons People Use Storage Units:

- Not Enough Space at Home – This could be due to a growing family or simply because they have too many belongings.

- Downsizing Home – When people downsize, they may not have enough space for all of their belongings.

- Moving Somewhere – Moving can be a chaotic time, and people often need a place to store their belongings while they’re in transition.

- Temporary Housing – Sometimes people need a place to store their belongings while they’re in between homes.

- Loved One’s Possessions – After a loved one passes away, people may not have space for all of their belongings.

- Extra Business Space – Businesses may need extra storage for inventory, equipment, or files.

- Boats, RVs, etc – People often need a place to store their recreational vehicles when they’re not in use.

Wrapping Up

Storage units can be a lucrative investment, but it’s important to consider all of the factors involved before making a decision.

With careful planning and a bit of research, you can be well on your way to success in the storage unit business.

Tara is a licensed real estate agent in Southwest, FL. She helps buyers and investors find their dream home by educating them about real estate and how they can use it as an investment.