Budgeting is a buzzword on a lot of people’s minds this year.

Although budgeting statistics say that the average person is trying to be more financially intelligent, it’s hard to do if you don’t have guidance.

Although it can take time to get used to a budget and create one that works well for you, soaking up money-saving statistics is the best place to start.

- Budgeting’s impact on people’s lives statistics

- Psychological effects of budgeting statistics

- Budget categories statistics

- Consequences of not budgeting statistics

- Low income budgeting statistics

- High income budgeting statistics

- Budget tracking statistics

- Budgeting for business statistics

- How to structure a budget statistics

- Savings account statistics

How Budgeting Can Impact Your Life Statistics

If you haven’t taken the time to budget before, you may feel a bias towards spending how you currently do.

Some people assume that budgeting is unnecessary: but that’s not true. These money management facts can open your eyes to what impact budgeting can make.

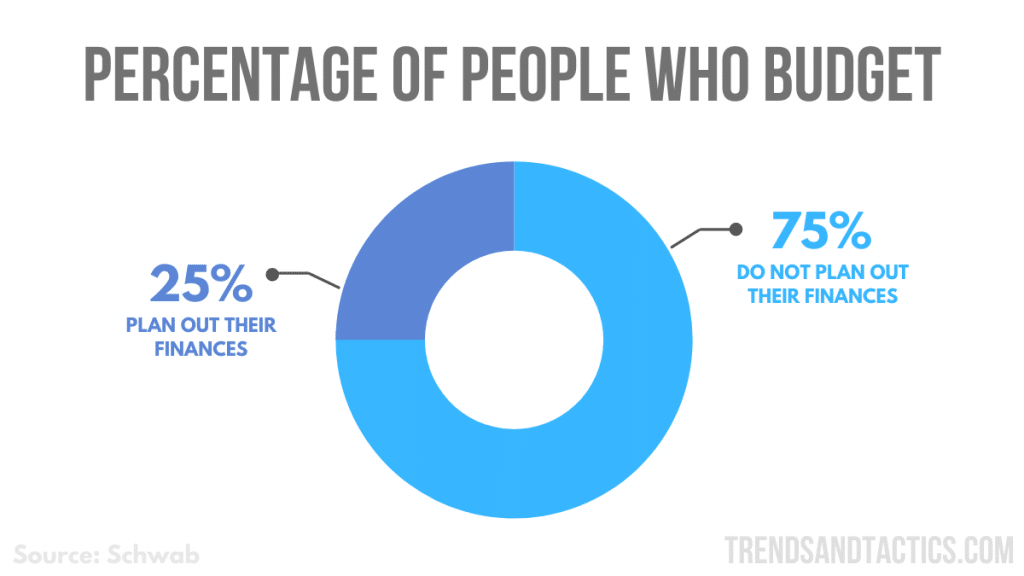

- Most people don’t budget at all, with 75% of people neglecting to layout their finances. (Schwab 2019 Modern Wealth Index)

- Despite that low amount of participation, 58% of people say that they would like to set up a budget if they knew how to do it correctly. (Clutch)

- Many people make it into an identity, with 59% of people saying they’re savers and care about their income to spending ratio. (The Penny Hoarder)

- Many professionals say reviewing your yearly budget every time 25% of the year has gone by and reworking it will allow you to make better financial decisions. (Small Biz Trends)

Physiological Effects of Budgeting Statistics

If you’re new to budgeting and nervous about the amount of work and willpower that will go into it, here’s some information you need to know.

- The wealthy see themselves differently than the public perceives them. Because of their strict budgeting, only 13% of people with a million dollars see themselves as wealthy or rich. (Ameriprise)

- Although 18% of people say they budget entirely in their heads, those who write it down are proven to be more success budgeting. (University of Rhode Island)

- Those who are married are far more likely to have a budget, with 58% of married people claiming to budget since the income is shared. (University of Rhode Island)

- Financial strain like loans can push people into budgeting, with 62% of those with a high-cost loan being avid budgeters. (University of Rhode Island)

- This carries across to mortgages, where 60% of those with a mortgage also budget to protect themselves from being unable to pay. (University of Rhode Island)

- The pressure of children can also encourage people to budget since 63% of those with dependants claim to have a budget. (University of Rhode Island)

Budget Categories Statistics

When budgeting, many people notice that they’re spending their money in wild and incorrect ways.

These are some ways that people waste their money without realizing it.

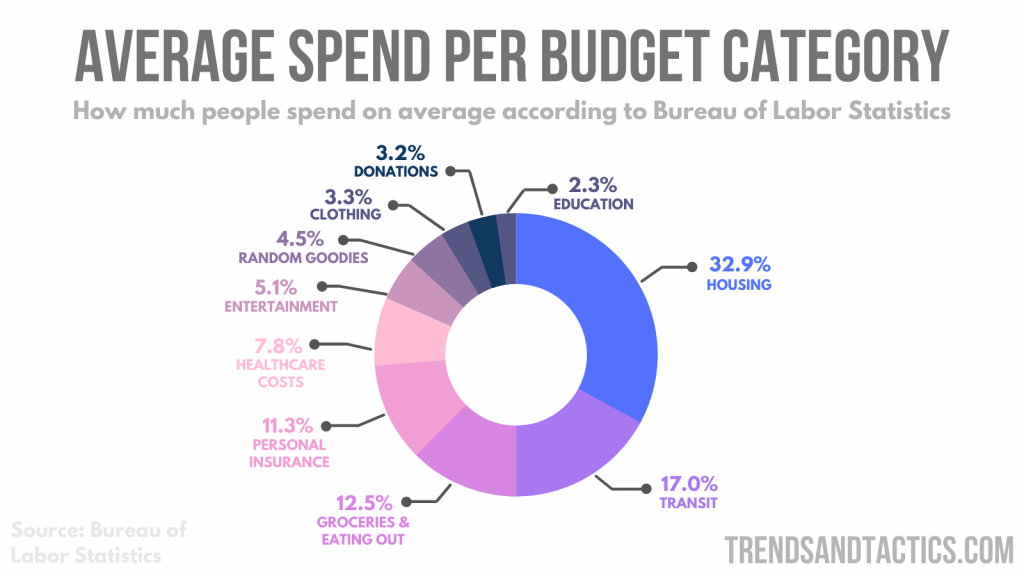

- At 32.9%, housing is the largest chunk, and is often the largest expense in someone’s life. Making up almost a third of our income, which limits how much we can spend on more fun things in life. (Bureau of Labor Statistics)

- 17% of the average person’s income goes to transit. This ranges from public transit to cars and even plane tickets. (Bureau of Labor Statistics)

- 12.5% of the average person’s income goes to food, whether that be groceries or eating out. (Bureau of Labor Statistics)

- 11.3% goes to personal insurance outside of those medical costs. (Bureau of Labor Statistics)

- 7.8% of the average American’s income goes to healthcare costs from doctor’s visits. (Bureau of Labor Statistics)

- 5.1% of spending goes to entertainment like movies, television and other fun. (Bureau of Labor Statistics)

- 4.5% of a person’s budget is spent on anything from random goodies in stores to website subscriptions. (Bureau of Labor Statistics)

- 3.3% of the average American’s income goes towards apparel and clothing. (Bureau of Labor Statistics)

- Cash contributions to things like churches and community make up 3.2% of the average person’s budget. (Bureau of Labor Statistics)

- 2.3% of the average budget goes to education. (Bureau of Labor Statistics)

Consequences of Not Budgeting Statistics

If you have enough money in your account and don’t have to worry about small expenditures, you may think you get a free pass from budgeting.

But, unfortunately, this is a dangerous road to go down. These statistics discuss what can happen if you avoid budgeting.

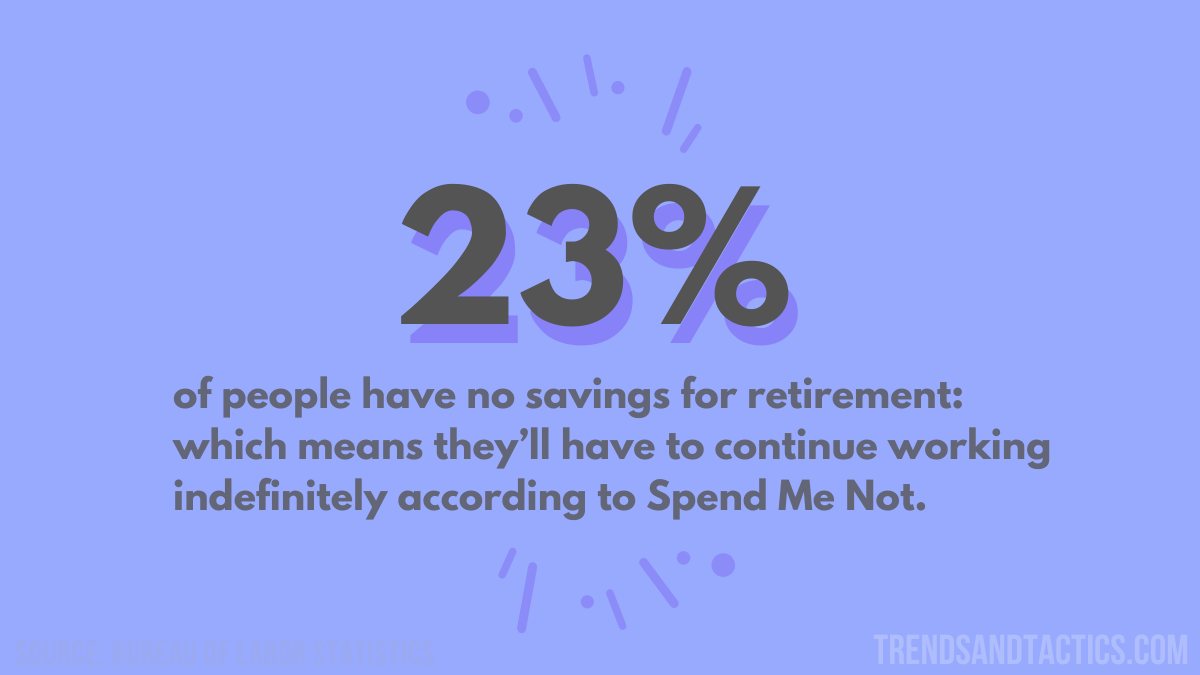

- Failing to budget can leave people working for their entire lives. 23% of people have no savings for retirement: which means they’ll have to continue working. (Spend Me Not)

- 31% of people have fully accepted that they’ll probably have to keep working beyond retirement age. (Employee Benefit Research Institute)

- 25% of people have said that they were so embarrassed by poor spending that they hid their purchases from their spouses. (The Penny Hoarder)

- Only 24% of Millennials seem to understand the basics of saving despite many of them now entering their peak income years. (Fortunately)

- 20% of people have said that splurging without considering the effects of it negatively impacted their financial health. (The Penny Hoarder)

- Unfortunately, 8% of people have credit card debt between $5,000 to $10,000 because of this. (The Penny Hoarder)

- 26% of Millennials have admitted to having overdrawn their financial accounts within the last year. (In-Charge)

- Another 29% admitted to being late with their mortgage payments. (In-Charge)

Low-Income Budgeting Statistics

Although being too lax with your budget can hurt you financially, you can also do harm by being too strict.

Binge spending after holding yourself back is a hazard, here’s why.

- Many can’t afford to save; almost 75% of workers claimed to have trouble making enough money every month. (Career Builder)

- Over 50% of Americans have less than a month of income saved in case of emergencies. (Market Watch)

- 19% of Americans have no savings whatsoever. (Market Watch)

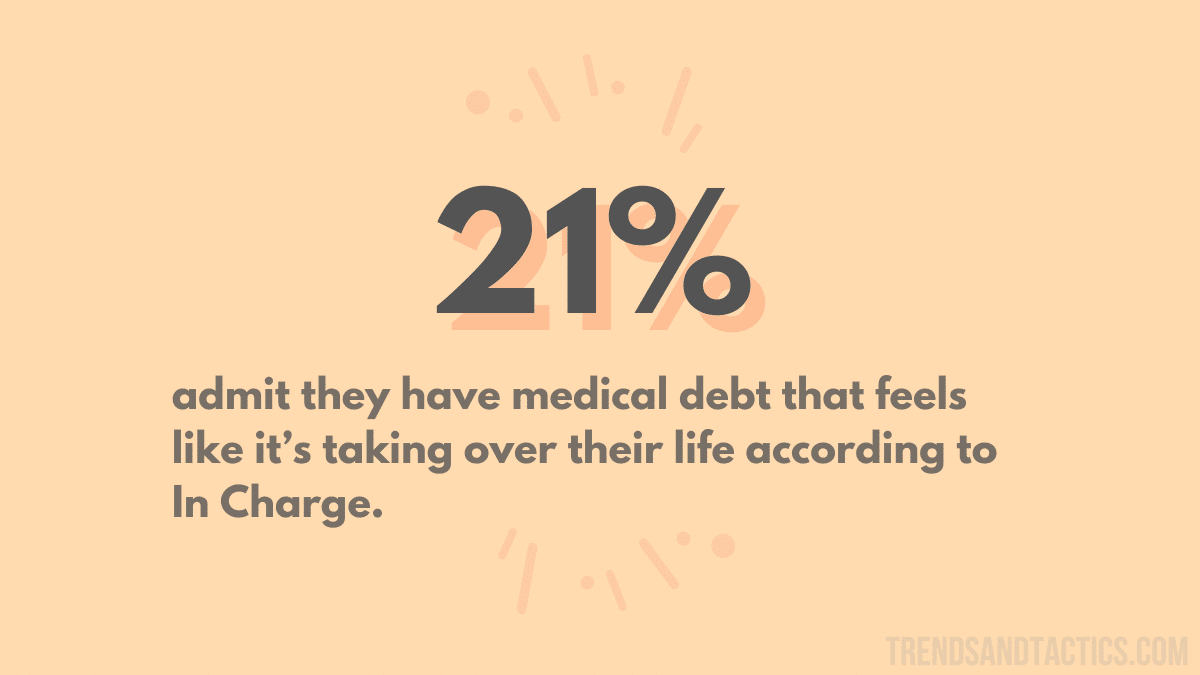

- 21% admit they have medical debt that feels like it’s taking over their life. (In-Charge)

- 74% of Americans would find themselves in a financial crisis if their income were put off by more than a couple of weeks. (Pocket Sense)

- Those who make less than $25,000 a year are the least likely group to have a budget: with only 54% of them claiming to be interested in budgeting. (University of Rhode Island)

High Income Budgeting Statistics

Some people think that once you’re wealthy enough, you can spend money on whatever you want.

Although this is true to a slight degree: poor spending could result in you having no wealth at all. These statistics are why it’s important to budget at any level.

- Those who made at least $75,000 a year were far more likely to start budgeting or already have a budget in place. (In-Charge)

- Only 18% of those earning more than $100,000 a year are living paycheck to paycheck. (The Penny Hoarder)

- Because of a propensity for budgeting, many millionaires spend 43% less on staples like groceries than their less wealthy peers. (Ramsey Solutions)

- Many of the wealthy diversify so that their 80% of income is from many sources, allowing their budget to be larger. (CNBC)

Budget Tracking Statistics

Laying out your budget and planning carefully can change everything.

If you’re unsure how to design your budget, and feel confused about these first steps: you’re not alone. These are some statistics on how people build their budgets.

- Don’t worry if you’re new to budgeting! Over 59% of people polled by the Penny Hoarder said that they didn’t know how much money they present in the last month. (The Penny Hoarder)

- You don’t have to do it on paper! 40% of people say that they do their budgets in a spreadsheet every month. (Schwab 2019 Modern Wealth Index)

- Many have cracked the code! 14% of people use an application on their phone to make tracking and updating far easier. (The Penny Hoarder)

- Mint was the most popular budgeting app, having a hold on 42% of the market.

- EveryDollar was second at 17% using it. (The Penny Hoarder)

- You Need A Budget, or YNAB snatched up 18% of the remaining customers.

- Personal Capital was the final at just 3%. (The Penny Hoarder)

Budgeting for Businesses Statistics

When starting a new business, budgeting might seem as simple as – spend less than you make.

But without careful budgeting, it’s common to spend far more than you expect. Therefore, budgeting is just as critical for businesses as it is for individuals.

- 61% of small businesses didn’t have business budgets last year. (Small Biz Trends)

- 79% of larger enterprises, in contrast, did have a budget set up. (Small Biz Trends)

- 60% of those with savings had learned to do it over time since they ran the business for at least five years before being polled. (Clutch)

- Unfortunately, it’s still a learning curve since only 50% of companies with a budget could stick to the amount they wanted to spend. (Small Biz Trends)

- 11% of businesses came out under budget and were able to save more. (Small Biz Trends)

- 36% spent far more than they had budgeted for. (Small Biz Trends)

How to Structure a Budget Statistics

Even though we may think we know how our money is supposed to be spent, many of us never had the chance to build a healthy relationship with money.

To spend correctly, you have to know where your money should be going. This is a better breakdown.

- Housing Costs – 25-30% of your income should go to either rent, a mortgage, or saving for a home. Aim for 25% to give yourself more wiggle room. (Spirit Financial)

- Food – 10-15% is a reasonable amount of money to spend on food if you resist eating out. (Spirit Financial)

- Transportation – 10% is far more reasonable than 17%, especially with public transit as a fantastic eco-friendly option. (Bureau of Labor Statistics)

- Utilities – 5-10% is the average to be spent on utilities. It’s important to block out part of your budget specifically for them. (Spirit Financial)

- Personal Spending – 5-10% is a good amount to set aside for everything from clothes to goodies in stores. Don’t exceed this. (Bureau of Labor Statistics)

- Charitable Giving – 5-10% is plenty to spend. Giving money like this is good for mental health and confidence, and shouldn’t be avoided. (Spirit Financial)

- Saving – 10-20% of your income should be invested back into you. (Bureau of Labor Statistics)

- Entertainment 5-10% can be spent on anything from television to movie theaters. (Bureau of Labor Statistics)

- Healthcare – 5-10% this varies based on personal situations. (Spirit Financial)

- Insurance 10-20% like health care, this will vary based on your situation. (Spirit Financial)

- Budgeting carefully and ensuring everything has its own spot encourages people to keep budgeting and will save from quitting it. (Bureau of Labor Statistics)

Savings Accounts Statistics

If you’re budgeting, you should be saving money too, right?

Although saving your money matters, many don’t see how budgeting can help move more into their savings. Fortunately, a good budget can change the way you save.

- The average worker sets aside 5% of their current earnings for savings. (LA Times)

- In 2020 the average American had $65,000 saved. (Northwestern Mutual)

- Unfortunately, that makes it seem like people have more than they do: only 38% of Americans have an emergency fund set aside. (Pocket Sense)

- This is surprising since 74% of Americans have a portion of their paychecks go directly into savings, meaning that they’re often spending from their savings as well as their main accounts. (Pocket Sense)

- Half of workers agree that they’ll need to save at least a million dollars to be able to afford to retire. (Spend Me Not)

- 69% of retirees state that they rely on their personal savings or investments as their main source of money to spend. (Employee Benefit Research Institute)

Conclusion

Although many may assume that a budget is just another way to store money and save up for the future, there’s more to it than that.

A good budget can help you reevaluate what purchases matter most in your life and can help you reconsider poor spending behavior.

No budget is simple; we all have to learn to create one that works for us: when you have a great budget, it can be life-changing.

Erin is a business teacher and mother of three. When she’s not in the classroom or fulfilling her obligations as an A+ hockey and lacrosse mom, she’s working on her latest article.