Unfortunately, needing emergency cash immediately is something most of us run into at some point in our lives.

Since only 69% of Americans have less than $1,000 in a savings account, needing to generate funds quickly is more common than we’d like to believe.

That’s why we’re here to help! We’ve collected some of the easiest ways you can generate cash both online and off, plus looked into what the best emergency loans online will look like for you and what you should expect.

If you’re feeling like you’re the only one who’s had to worry about finding an influx of cash quickly, you’re not alone.

We recommend utilizing a few different methods so that you have a higher chance of receiving money much faster than if you relied solely on one option.

Sell Plasma, Sperm, or Eggs

Check your local state regulations, as some may not allow the sale of body “parts” or fluids. You’ll also need to be in relatively good health to donate eggs or sperm.

For sperm and plasma, you can most likely receive a check after donating. Egg donations may take longer as they require a few weeks before harvesting.

Rent Out Your Home or Room

If you’ve got the space or live in a tourist-heavy area, consider using sites like Airbnb to rent out your home for a few days.

Starting an Airbnb business is easier than you might think these days.

You can crash with a friend or family member if need be, as renters will be more inclined to pay for your space when they don’t have to worry about being around the owner during their stay.

Check Out Gig Work

If you have any sort of skill set that can be monetized, there are websites out there looking for people just like you.

Sites like Fiverr and Upwork are great for people who know how to do things like editing, writing, social media posts, web design, marketing, sales, and customer service.

If you’re better at manual labor, try sites like local Facebook groups or your local Craigslist, as there are usually people looking to find moving or handyman services as quickly as possible.

Payment timelines vary, with some sites having thresholds before they’ll release funds (usually around $50) but you can generally expect to have money direct deposited into your account within a week.

Pawn off Valuables

If you need cold hard cash right away, it’s time to start clearing out your home. Electronics, TVs, gaming systems, jewelry, and collectibles can all be used to generate some quick cash.

If you decide to use a pawn shop, most shops will allow you to “loan” your valuables over to them.

This way, if you’re just looking for money to keep you afloat until the next payday, you might be able to get your beloved items back before they’re sold. If you know the best ways to sell things at flea markets, this is a great option as well.

Fix and Flip Electronics

If you’re inclined to be handy, you can make some great money flipping electronics that are left out on trash night.

Many things like televisions or laptops are thrown out, requiring a simple fix (check YouTube for tutorials).

You can then resell them to pawn shops and consignment stores or easily sell electronics on eBay, Facebook marketplace, or Etsy. Just a heads up, Etsy will only want electronics that are considered “vintage” (at least 20 years old).

Crowdfund

Sites like GoFundMe and Kickstarter are great for getting a pool of money from different sources.

GoFundMe is meant for more personal reasons like medical or credit card debt, while Kickstarter is better for entrepreneurs who need extra funds for their businesses.

Ask Friends or Family for a Loan

If you know someone who can help you out temporarily, it’s worth asking them for a loan (especially before heading to a payday loan place).

Some may be hesitant to lend you money as they might believe “friends/family and money don’t mix,” so don’t feel insulted if they decide it’s not in their power to help you.

One tip to help your chances is to try and come to them with a payment plan and collateral of some sort.

That way, they might feel it’s less of a risk of loaning you the money you need to cover whatever emergency you’re facing.

Start Working for Ridesharing Service

If you’ve got a car, consider signing up for Uber or Lyft as you can start driving for them relatively quickly.

There are also bike-share apps around the country, but these are usually for delivery services like PostMates.

If doing taxi services aren’t your thing, apps like GrubHub, DoorDash, and UberEats let you pick up and drop off deliveries instead.

Use Online Task Sites

If you don’t feel like there are skills you can monetize, try looking for websites which reward small tasks that most people can do.

Sites like Mechanical Turk utilize people to do small things like surveys, data entry, or basic copywriting.

Survey sites like Pinecone Research or UserInterviews will pay you to take part in surveys that you qualify for. Payments are usually made within a week.

Rent out Your Car

Sites like Turo will allow you to rent out your car for a day or even a few hours.

They don’t operate in every state, so check ahead of time to see if short-term car rentals are an option for your area.

Look Into Babysitting or Dog Walking

Sites like care.com and rover.com are great for people who love kids and pets.

You might need a few references to stand out, but getting established on these sites is pretty easy.

Sign Up for Contests

Check to see if any crazy contests are happening in your area.

There may be endurance-style contests where the last person standing wins or eating challenges like the person who eats the most hot dogs wins.

Try using sites like dietbet or HealthyWage to sign up for weight-loss contests if you’re disciplined.

Use Your Social Media Platform to Your Advantage

If you have any sort of social media following, you may be able to leverage that for sponsored posts.

Reach out to brands that run social media campaigns and see if they’ll agree to pay you for a review or featured content.

Even if the brand decides to give you product-only, you may be able to sell that after your post to generate some extra money.

Sell Unused Gift Cards

Sites like GiftCardGranny or GiftCardSpread will pay you for the unused balance on old gift cards. Many will give you an instant payment if you have e-gift certificates.

Get an Emergency or Payday Loan

If none of these options work for you, consider using a payday or emergency loan service. Just make sure you understand what terms you agree to and can make the payments on time.

Getting an emergency loan might be a faster solution than the rest, but that doesn’t mean it’s best for every situation.

Let’s talk a little more about what type of emergency loans are available and what to expect when applying for one.

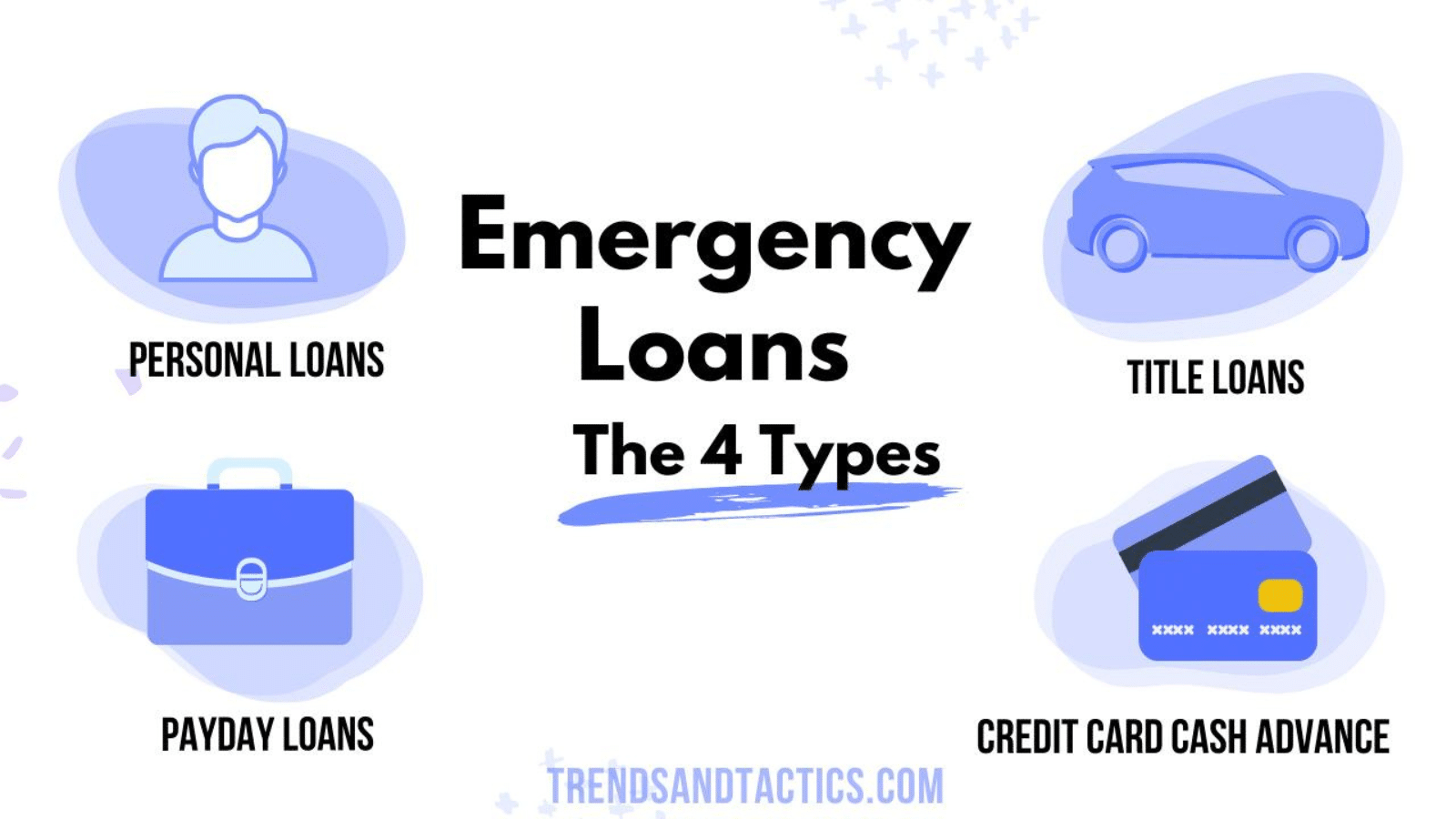

Types of Emergency Loans

Emergency loans cover a broad range of options, but generally, there are four types of loans available for individuals who need money quickly:

- Personal loans – These are from banks or local credit unions. It may take a few days to receive funds, and you’ll most likely need to have decent credit or at least a longstanding relationship with the bank. Payments are typically made for a fixed amount of time with a standard amount every month until the loan is paid in full. Depending on the amount of the loan, the bank may require some sort of collateral.

- Payday loans – Payday loans are offered by businesses that give short-term loans for people who run into an emergency that can’t be put off until the next payday. These are usually under $500 and can have very unfavorable APRs. However, they don’t require credit checks and will usually approve the loan in a matter of hours.

- Title loans – These are loans that use your vehicle title as collateral. Like payday loans, these are more for short-term use. The average loan runs for about 30 days. If you cannot make payments on the loan, the business can seize your car to pay off the balance.

- Cash advance from your credit card – There’s currently over $3 trillion of available credit in the United States. If you’ve got a credit history and have available credit on your cards, you may be able to use those for cash advances. Most credit card companies will make up to 50% of your available credit open for a cash advance. The advance may be either directly deposited to your bank or may be withdrawn from an ATM. Cash advances generally have a higher interest rate than your standard APR and will accrue interest immediately.

Will Applying for an Emergency Payday Loan Affect My Credit?

Many wonder if utilizing emergency or payday loan services will affect their credit report. The answer is.. it varies.

- If applying for a personal loan with a bank, you can expect a hard pull to happen to your credit report.

- If using a cash advance on your credit cards, you won’t see any change to your credit history unless you’re unable to pay your advance off before the next statement closes. Otherwise, your credit utilization may go up.

Payday lenders rarely run credit checks, so just applying won’t affect your credit score. Also, if you pay your loan off on time, it shouldn’t affect your report.

If you fall behind on your payments, though, they may come after you with collections which then hits your credit report.

Speaking specifically of payday loans, it’s important that you understand how predatory they can be ahead of time. APRs with payday loans are not regulated by the government like standard loans or credit cards are.

Consequently, you may see interest rates as high as 400%! It’s no surprise that 80% of payday loans are rolled over because borrowers just can’t pay back the principal and interest rate quickly.

What Should You Know About Emergency Loans Before You Apply

If you’re considering an emergency loan, there are a few things you should know ahead of time:

- Funding times vary – Personal loans may take a few days, while cash advances or payday loans may be available within an hour. Ensure you’re not caught off guard and ask when you can expect funding to be given before applying.

- Interest rates are not standard – Personal loans and cash advances, while high, still have more reasonable interest rates than things like payday or title loans. There’s little regulation for emergency loans, so don’t expect that the rate a bank offers you would be the same rate you receive from a payday loan business.

- Payment terms can often be predatory – Most businesses want emergency loans paid back as quickly as possible, and falling behind can be costly. Read the fine print of any loan agreement before signing and have a plan for how you expect to make your payments. The sooner you can pay back your loan, the better off you’ll be.

Conclusion

Being in a bind for money is more common than you think, so don’t feel ashamed if you’re in a rough situation.

Use our tips to generate some ideas for how you can create emergency cash quickly, and you’ll be on your way to moving on in no time.

Profitable Stock Traders are Using This Tool to “Hack” the Markets

This tool is helping traders beat the market compared to those who have no idea what is. Here are the Top 28 Stock Trading Discord Servers Right Now.

10 Industries That Will Make The Most Millionaires In The Next 5 Years

If you are not paying attention to these 10 industries, you are about to miss out on the next boom of millionaires. See the 10 Industries About to Make the Most Millionaires in the Next 5 Years.

8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

These are 8 cryptocurrencies you need to know about before you miss out on the next boom. 8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

We share the top 10 stocks that Bill Gates owns that smart investors are buying right now. 10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

The 27 Unexpected Habits Of The Wealthy: Secrets To Maximize Your Money

The wealthiest people on Earth share similarities in their habits. We break down the 27 habits you would not expect! The 27 Unexpected Habits Of The Wealthy: Secrets To Maximize Your Money

Top 6 Personality Traits Of Highly Successful Investors And Traders

From Warren Buffett to Ray Dalio. We breakdown the top 6 common traits the most successful investors and traders have. Top 6 Personality Traits Of Highly Successful Investors And Traders

Jack Brewer is passionate about all things personal finance, and enjoys testing out new side hustles and investing strategies.