Studies show that 74% of the population has a budget in place, yet 79% of those same people struggle to follow it.

As a result, a large percentage of consumers are looking for budgeting software to get their finances under control.

Let us assist you with the process of comparing the 2 leading personal investment tools out there – Quicken and Mint, so you make the right choice.

The 3 Critical Features for Any Great Budgeting Tool

To help you decide what tool is the most helpful for your situation, consider what you want it to do.

Here are some of the critical features that you should think about as you make your choice.

1. Gives you a clear, overall financial picture

If you are new to budgeting, you may think your end goal is simply to manage your cash flow. While this is an essential part of budgeting, it doesn’t give you an overall financial picture.

When deciding between Quicken vs. Mint consider choosing the program that allows you to track your assets and liabilities so that you can know what your net worth is at any time during the month.

2. Links to your checking account

One of the quickest ways to fail at budgeting is by starting a program that requires you to input each of the transactions you make daily. You may start strong and dutifully recording each coffee purchase.

When life gets busy (and it always does), that is one task that will fall to the wayside. Make sure your bank account “talks” to your budgeting software before deciding on one. If you use a major bank with hundreds of branches in North America, this shouldn’t be a concern.

3. Has bank-level security

Please do not overlook the importance of keeping your accounts secure. Choose a tool that takes cybersecurity seriously.

For those who are tentative with linking all your most important financial accounts to one platform, both Mint and Quicken allow you to submit your financial data without linking the accounts.

Of course, this may be tedious, but you will sleep well at night, knowing that fewer companies have access to your bank account.

Main Difference Between Mint vs. Quicken?

Once you have determined that your bank and investment companies “talk” with both Mint and Quicken, you have to consider the main differences between the two products to make an informed decision.

We will do a deep-dive into the Mint vs. Quicken differences in the following sections, but for now, you need to know one thing: Mint is free.

If you are “cash poor” and want an easy way to save money, it only makes sense to begin your journey with a free tool.

How many times have you signed up for a new gym in January with a lengthy contract? You may start the year paying less than a dollar for each visit, but as the year progresses, the number of times you go to the gym divided by the monthly cost may leave you with an unsettled feeling.

Paying for Quicken if you aren’t going to use it would also be a waste of money. On the other hand, you may be more likely to use something if you paid for it.

There are a few other significant differences between Quicken and Mint that you should consider before we dig too deeply.

| Quicken | Mint | |

| Credit Tracking | Quicken users can monitor their quarterly credit score on Equifax. | Mint users can not only track their score on TransUnion as soon as its update, they can also get tips for improving their score. |

| Investment Features | Quicken offers a robust set of investment tracking tools, including the means to track loans, investments, retirements. It also provides options to evaluate and help improve your portfolio. | Mint users can monitor taxable brokerages accounts, IRAs, 401 (k), mutual fund accounts. They can even compare their accounts to market benchmarks. A big help to many Mint users is its free analyzer service that displays broker fees. |

| Budgeting Approach | With Quicken, you can create a budget, categorize your spending, and then track it by exporting your spending to Excel to analyze. | Mint does things differently. It helps you create a budget based on what you spend. It categorizes your spending to show you where your money is going to make a budget based on how you spend your money. |

Here are some of the other similarities and differences between Quicken or Mint.

Ease of Use

If you are comfortable with the terms “Balance Sheet” and “Statement of Cash Flow,” you will feel comfortable using Quicken. If thinking about money leaves you slightly nauseous, you might feel more comfortable using Mint.

There is a slight learning curve to using Quicken that you may not experience with Mint. This is probably because Quicken allows you to run dozens of different types of financial reports.

Even though Quicken is undoubtedly usable for beginning money managers, they may feel a tad bit overwhelmed with all the additional data that can be tracked with Quicken.

As you continue on your financial journey and become an adept money manager, you may feel that Quicken is the right choice for you.

On the other hand, Mint markets its product as a “fresh way to manage money.” It is created for those from every walk of life and doesn’t assume you know anything about accounting terms. The set-up process is intuitive.

Mint needs to work on one critical area that affects its ease of use. Some users report issues with synchronization from certain online accounts.

If this happens, you may find yourself having to input data manually into the system, which may reduce the likelihood of using such a product.

| Quicken | Mint | |

| Reporting Options | Quicken offers dozens of in-depth financial reports. | Mint offers quick, at a glance reports. |

| Learning Curve | Quicken offers many customizable options, which means it has a slight learning curve. | Mint is easy to set up and get started. |

| Bank Synchronization | Quicken merges information with your bank account seamlessly. | Users report that on occasion they have to manually input information to Mint. |

Design

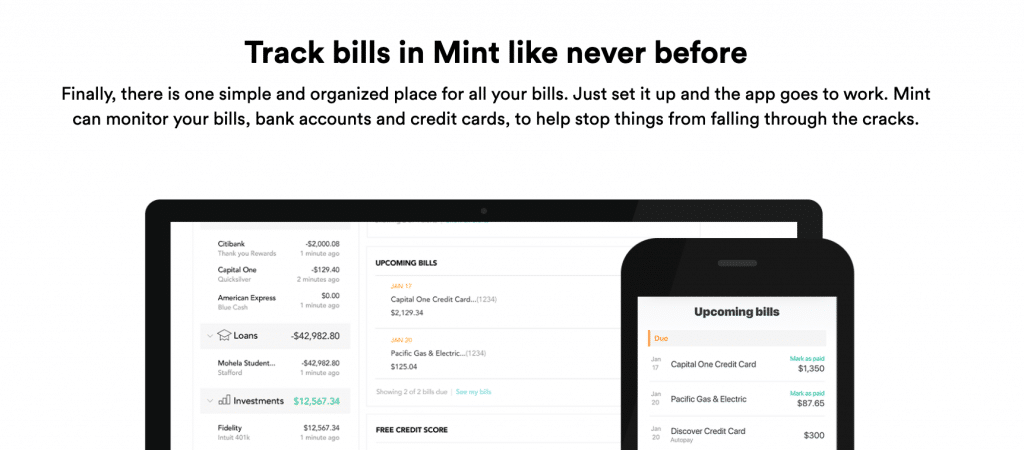

Mint has a much sleeker, more modern design than Quicken. It presents information in a more personal way. Mint allows you to set a customized goal, such as saving money for a down payment for a house or paying off student loans.

From the app or the Mint website, you can see a clear report on how you are progressing toward that goal, encouraging other healthy spending habits.

We also like Mint’s “Mintsights,” which pats you on the back for making good financial choices. It also alerts you to any bills that may have increased over the last month, and it offers simple budgeting tips.

One reason that the design for Mint is much more attractive is that it does not offer the tools that Quicken does. Fewer options come with sleeker, less-cluttered designs.

Design is important. If you are easily overwhelmed with money, the program’s design may hinder you from using it.

| Quicken | Mint | |

| Graphs and Reports | Quicken produces pie charts and bar graphs, allowing you to compare how much you have spent on the budget and what you spent last year (month or week) compared with the current week. | Mint enables you to focus on a financial goal by giving you a single-page tracker that shows your progress. |

| Insight Capabilities | Quicken enables you to predict your projected balance by considering your spending and what bills are due soon with your current cash projections. | Mint has an easily viewed calendar that allows you to see the bill due dates that are approaching and how that will affect your cash flow. |

| Ease of Use | Quicken allows you to see all your accounts in one place. | Mint will give you alerts as to when bills are due. |

Mobile Functionality

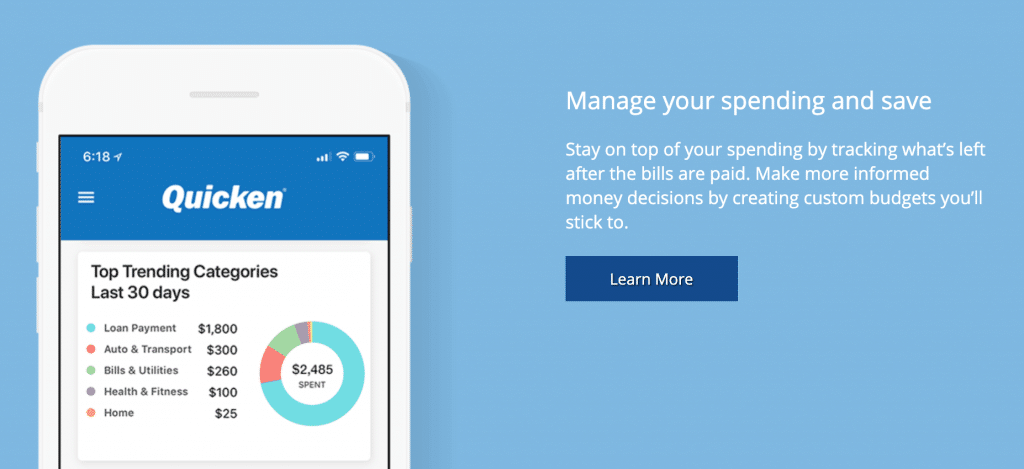

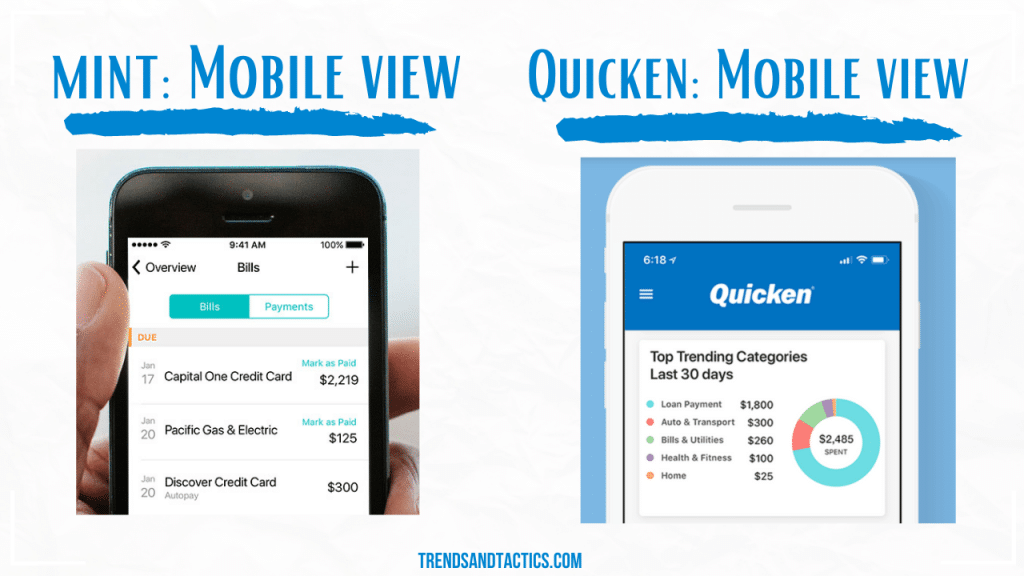

Quicken finally caught up with the time, and the tool now offers an app for its users. Without this upgrade, it would have been difficult for anyone to have recommended Quicken over Mint.

After all, you will only be successful with your budgeting and tracking if you can get a quick overview of your spending while visiting a store.

Both Mint and Quicken allow users to seamlessly move from their app to their desktop computer, tablet, or smartphone. The changes made to one automatically appear on the other. And, of course, they both have Android and Apple versions.

As far as comparing the mobile functionality between the two products, they are pretty similar. Your “best app” pick may come down to which design you prefer.

Customer Service

You shouldn’t be surprised to learn that Quicken has better customer support than Mint. After all, customers must pay for Quicken, so the company wants to give you all the resources you need to have a good user experience.

Quicken support options are also more prevalent because users are more likely to offer support to other users. These user forums on the Quicken website are great resources for those troubleshooting specific issues.

Before you judge Mint too harshly for their lack of support options, remember that the company prides itself on offering a personal budget app that is easy to use. You may simply not need that level of support when using Mint unless you have problems with your accounts syncing with the tool.

Pricing

Yes, free is good. No one would argue with that. While many in-depth guides lead with the fact that Mint is free, it’s not like purchasing Quicken would lead anyone into financial ruin.

Quicken is relatively inexpensive, especially considering the depth of the information it offers.

There are three Quicken purchase options. Here are the details for each one.

Quicken Starter

- Costs $35.99 per year

- Comes with desktop and mobile app

- Will categorize your expenses automatically

- Allows you to see all your accounts in one place

Quicken Deluxe

- Costs $51.99 per year (on sale now for $31.19 per year)

- Includes everything in Quicken Starter

- Allows you to create a customized budget

- Has a debt managing and tracking option

- Enables you to simplify your taxes and investments

Quicken Premier

- Costs $77.99 per year (on sale now for $46.79 per year)

- Includes everything in Quicken Deluxe

- Includes free online bill payment (not an option with Mint)

- Includes priority access to customer support staff

Even if you can’t find Quicken on sale, paying $6.49 per month for even the most expensive version wouldn’t bankrupt most people. Of course, don’t forget to add the expense to your monthly budget.

The Verdict

We promised to advise whether you should use Quicken or Mint as your personal financial tracker. After careful consideration, we recommend Mint. Here are our reasons.

Reasons to Choose Mint

- Easy to use

- Clean, clutter-free design

- Allows you to focus on one financial goal at a time

- Provides a secure setting to get a glimpse of all your accounts

- Creates a budget based on your spending history

- Great for those who are new to budgeting and tracking finances

There are users out there who have been using Quicken for decades. They have dutifully upgraded each time a new version was introduced, and they love discussing their favorite features and versions in long-winded blogs or twenty-nine-minute YouTube videos.

But, if you are new to budgeting and tracking your money, you don’t already have an emotional attachment to a product. You are more open-minded to other tools that are out there. Try Mint before you invest your money into Quicken.

While some money managers would argue that Quicken has more in-depth options, we think this may be a draw-back for some users.

It’s time to get started on that new year’s resolution to become better at tracking your finances. Whether you choose Quicken or Mint, get started today.

Erin is a business teacher and mother of three. When she’s not in the classroom or fulfilling her obligations as an A+ hockey and lacrosse mom, she’s working on her latest article.