Embarking on the journey of homeownership is an exciting and significant step, but it’s not without its potential challenges. From financial considerations to unforeseen repairs, and even the emotional rollercoaster of the buying process, there are several aspects to navigate. However, it’s important to remember that these challenges, while real, shouldn’t deter you from pursuing the dream of owning a home. In this guide, we’ll explore 18 potential problems with buying a house and offer insights on how to address them, ensuring a smoother path to achieving your homeownership goals.

Financial Strain

Financial strain may occur when the costs associated with homeownership, including mortgage payments and maintenance, exceed your budget. While it’s a potential problem, it shouldn’t be the sole reason to avoid buying a house, as proper financial planning and a manageable budget can help.

Hidden Costs

Hidden costs like closing fees and property taxes can catch buyers off guard, potentially affecting their financial stability. However, these costs are standard in real estate transactions and can often be anticipated and factored into your budget.

Home Inspection Issues

Home inspection issues, such as structural defects or plumbing problems, may seem daunting, but they can be addressed through negotiations with the seller or budgeting for necessary repairs. They shouldn’t deter you from buying a house outright, as most properties have some imperfections.

Property Value Fluctuations

Property values can fluctuate due to market conditions, but real estate is typically a long-term investment. While it’s a potential concern, the value of your property may appreciate over time.

Interest Rate Changes

Interest rate fluctuations can affect your mortgage payments, but securing a fixed-rate mortgage or refinancing can help mitigate this risk. Interest rates alone should not deter you from homeownership.

Maintenance Expenses

Maintenance costs are an ongoing concern, but responsible homeownership includes budgeting for maintenance and repairs. Regular maintenance can prevent larger issues down the road.

Property Taxes

Property tax increases can impact your budget, but they are often predictable and can be factored into your financial plan when purchasing a home.

Location Issues

Location problems, such as noise or crime, can affect your quality of life, but thorough research can help you find a suitable neighborhood that aligns with your preferences and needs.

Neighborhood Changes

While neighborhoods can change, consider the potential for improvement and research local development plans before concluding that your neighborhood may deteriorate.

Homeowners Association Fees

HOA fees can add to your homeownership costs, but they often provide valuable services and amenities. Carefully review HOA rules and fees to determine if they align with your lifestyle.

Liability and Insurance

Liability issues and insurance costs can arise, but proper insurance coverage and home safety measures can address these concerns without deterring homeownership.

Resale Challenges

Resale challenges can arise in specific markets or with unique properties, but a well-maintained and reasonably priced home can still attract buyers.

Legal Issues

Legal issues like property disputes are rare but can be addressed through legal counsel and due diligence during the buying process.

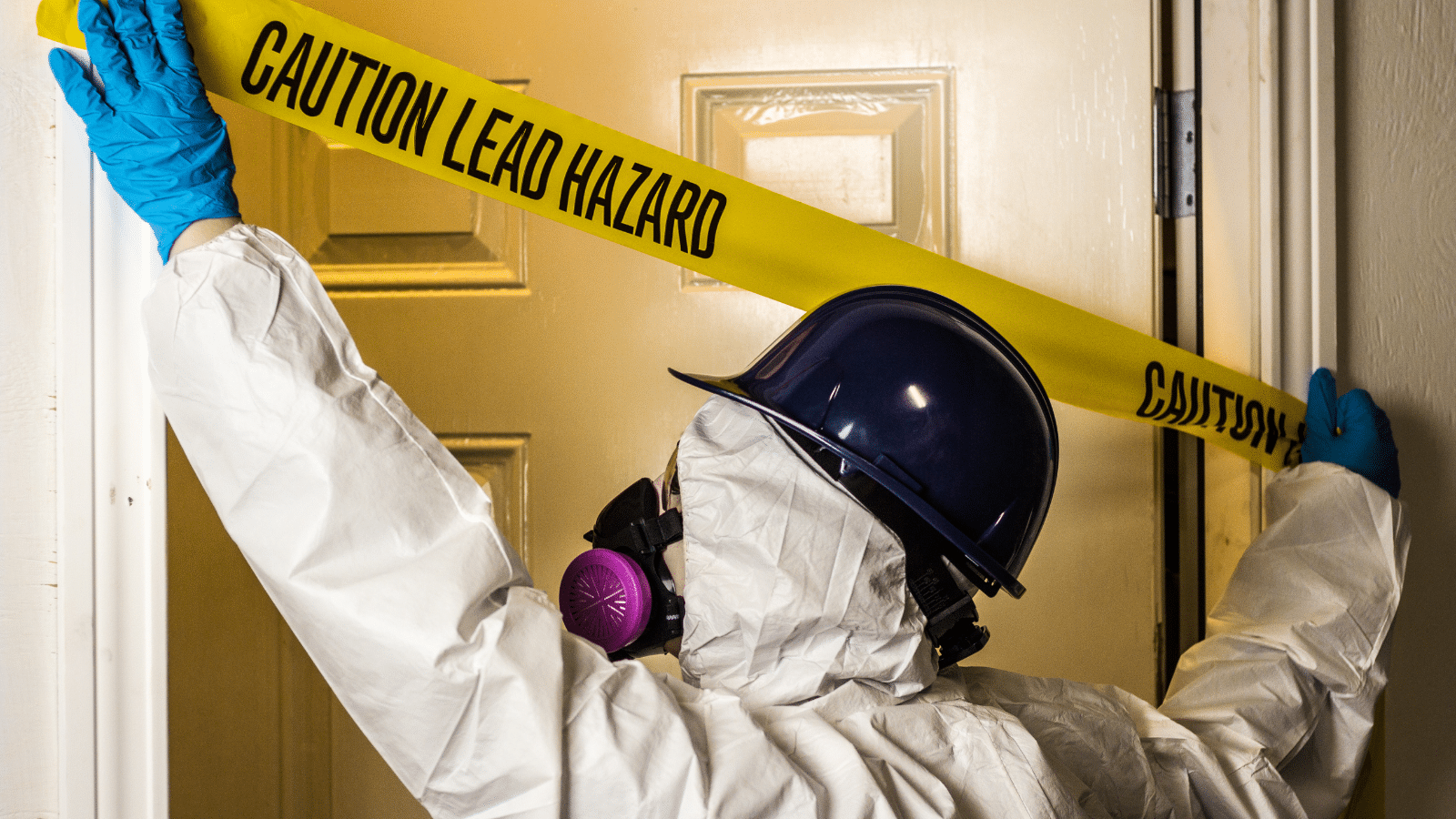

Environmental Hazards

Environmental hazards can be a concern, but thorough inspections and environmental assessments can help identify and mitigate risks.

Zoning Regulations

Changes in zoning regulations may affect property use, but consulting with local authorities and planning ahead can address potential issues.

Termites and Pests

Pest infestations can be managed with professional pest control, inspections, and preventive measures, rather than serving as a sole reason to avoid homeownership.

Overextending Finances

Overextending your finances can lead to stress, but proper financial planning and staying within your budget can prevent this issue.

Emotional Stress

Emotional stress during the home-buying process is common, but it’s a temporary concern that shouldn’t deter you from the long-term benefits of homeownership.

21 Things That Shout You’re “Lower Class” According To Men

Class wars creep up in all aspects of life, including dating. We take a look at the things that men believe are telltale signs that you are lower class.

21 Things That Shout You’re “Lower Class” According To Men

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

The change in the automotive industry has been incredible over the year. Baby boomers born between 1946 and 1964 can’t get enough of the cars listed below, as muscle cars emerged in the 1960s, and new technologies appeared in the 1970s and 1980s. You can imagine why boomers genuinely appreciate these vehicles.

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

There is a lot to love about America, from the bright lights of New York to the incredible breakfasts, but foreigners also dislike many things. We look at everything from poor public transport to an intimidating tip culture, sharing 18 things that America could be better at.

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

While some old habits die hard, there are some things that Gen X need to eliminate as they are no longer relevant.

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

18 Unpleasant States You Might Want to Skip on Your Next Trip

When thinking of America, we don’t expect there to be boring or unpleasant places to visit. We see all the different states on the TV, and they show the best parts. However, there are some states you won’t want to visit, and you should brace yourselves if you ever happen to stumble into them.

18 Unpleasant States You Might Want to Skip on Your Next Trip