When baby boomers hit retirement, they decide that it’s their time to live, and that’s when they go into buying mode and purchase items that just aren’t needed. Quite frankly, these items should never be purchased. Once retirement hits, it’s time for boomers to make a few adjustments because they go from having a regular paycheck to living on a fixed income. You might think it crazy to think that back in the 1930s, there was a much shorter life expectancy. According to data found by the Social Security Administration, the life expectancy for a man was 58, and a woman was 62. They wished they could live long enough to enjoy a few retirement years during these times. We have compiled a list of five things that boomers should rarely buy in their retirement years.

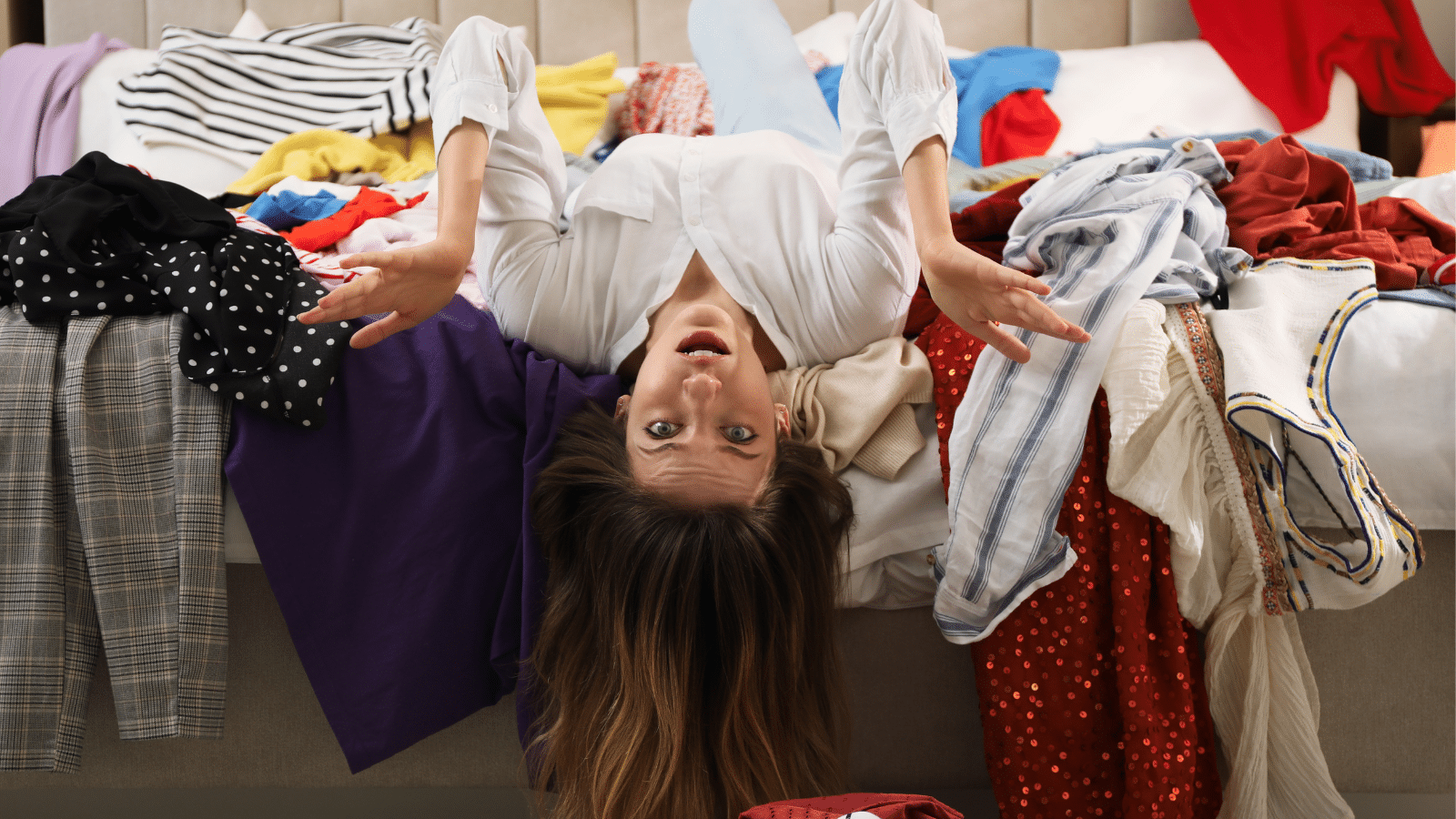

Large, impulsive purchases

It’s essential to spend your retirement continuing to budget, which means not spending money on large and impulsive purchases. This can be difficult when you’ve spent most of your life working and earning the money you are entitled to. Creating a budget is easy, but sticking to it is difficult. Americans spend more than $3,600 per year on impulse purchases, but retirement savings will go down much quicker when these become more significant items like expensive cars. Impulse spending will cause a bigger financial strain, leading to regret. Take some time to review your finances and think about whether the big purchase you want is a genuine necessity or something you desire.

High-risk investments

When baby boomers retire, they often consider risking their capital instead of preserving it. Even though the thought of having a high return is appealing, there is a risk of a significant loss. There is less time as you get older to wait out economic downturns, so it’s essential to ensure your stocks are over-represented. Spending time rebalancing your portfolio occasionally will ensure that you have the right mix of assets (including cash, stocks, CDs, and bonds). This will also give you an idea of any appropriate risk levels for your changing needs through retirement. Before investing, you must research and understand your financial products.

Second Homes

When going through retirement, many boomers decide to buy a second home. Whether it’s a place to visit in the summer, like a winter getaway or cottage country, it might initially be seen as a place that will follow in their legacy, and they can leave it to their children. However, if you decide to own several properties at one time, it can burden your finances. Even if you choose to rent it out for another source of income, you still need to consider the outgoings, such as maintenance, mortgage, taxes, and insurance. These will have to be paid even if nobody is living in it. If you have a property within a different country, these costs will be even higher. Before you invest in a vacation home, it’s best to consider the work that will have to go into it, and even if you have a management company to help handle it all for you, you will have to share the profits.

Expensive Vacations

We can all agree that traveling and cruises are a great way to spend your retirement, but there is something to consider before doing so. Travel costs are rising, and because of inflation and higher interest rates, a cheap holiday could break the bank now. All flights and hotels are becoming extortionate, and even though this might put a lot of off, boomers are still lapping it up. It’s essential to find a balance between enjoyable and affordable travel, and it might be worth considering taking a trip off-season when the prices aren’t as high. Some companies offer senior discounts on attractions and hotels. So, consider this first; otherwise, your retirement savings will soon decrease.

Timeshares

Often, timeshares can be seen as an “investment,” but as soon as you take ownership, this depreciates. A timeshare enables you to have partial right to a holiday home. This home will be accessible to you during the exact times each year. However, timeshares come with limited flexibility and high maintenance, making them inflexible and a costly investment for retiring people. It isn’t easy, or sometimes possible, to change your time slot, but you are still expected to pay the increasing annual maintenance fees. A one-week timeshare interval has an average price of $21,455, according to data from the American Resort Development Association (ARDA) in 2020. The maintenance fee annually ranges from $640 to $1,290. It’s better to consider staying in a hotel or vacation home.

21 Things That Shout You’re “Lower Class” According To Men

Class wars creep up in all aspects of life, including dating. We take a look at the things that men believe are telltale signs that you are lower class.

21 Things That Shout You’re “Lower Class” According To Men

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

The change in the automotive industry has been incredible over the year. Baby boomers born between 1946 and 1964 can’t get enough of the cars listed below, as muscle cars emerged in the 1960s, and new technologies appeared in the 1970s and 1980s. You can imagine why boomers genuinely appreciate these vehicles.

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

There is a lot to love about America, from the bright lights of New York to the incredible breakfasts, but foreigners also dislike many things. We look at everything from poor public transport to an intimidating tip culture, sharing 18 things that America could be better at.

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

While some old habits die hard, there are some things that Gen X need to eliminate as they are no longer relevant.

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

18 Unpleasant States You Might Want to Skip on Your Next Trip

When thinking of America, we don’t expect there to be boring or unpleasant places to visit. We see all the different states on the TV, and they show the best parts. However, there are some states you won’t want to visit, and you should brace yourselves if you ever happen to stumble into them.

18 Unpleasant States You Might Want to Skip on Your Next Trip