Whether you retire early and must ensure you have enough money to enjoy the last decades of your life, or you retire late and need medical care, being frugal with your money is essential. We look at 18 things people regret spending a lot of money on when they retire.

Extravagant Travel

Many boomers love to work and play hard, so they want to splash out big time when they retire. The temptation to book a lavish vacation is too much for some boomers, but they could be making a big mistake. As well as making a significant dent in the retirement budget, fancy trips early on in retirement can give people the taste and will leave them in spend mode.

Holiday Homes

Some retirees feel that investing in a holiday home will save them money in the long run as they don’t need to book many different vacations. The truth is that holiday homes can be a money pit as they need maintenance when you are not living in them, and if you rent them out to other guests, cleaning fees can be huge.

Timeshares

People often invest in timeshares rather than holiday homes when they retire, but they are only sometimes wise investments. You should read the fine print on any agreement to know it is the right home for you and there are no hidden costs.

Dream Homes

Retirees who are happy to stay home rather than travel look to invest in their “dream home.” A dream home may be an extension of their existing house or an upgrade to a larger home with their retirement fund. However, many people make the mistake of budgeting for the initial build but do not consider the cost of maintaining and repairing large homes.

Luxury Cars

If boomers are happy in their homes, they may spend money on luxury cars. While fancy cars may bring immediate fun, the value of vehicles decreases quickly, and all you are left with are expensive repairs.

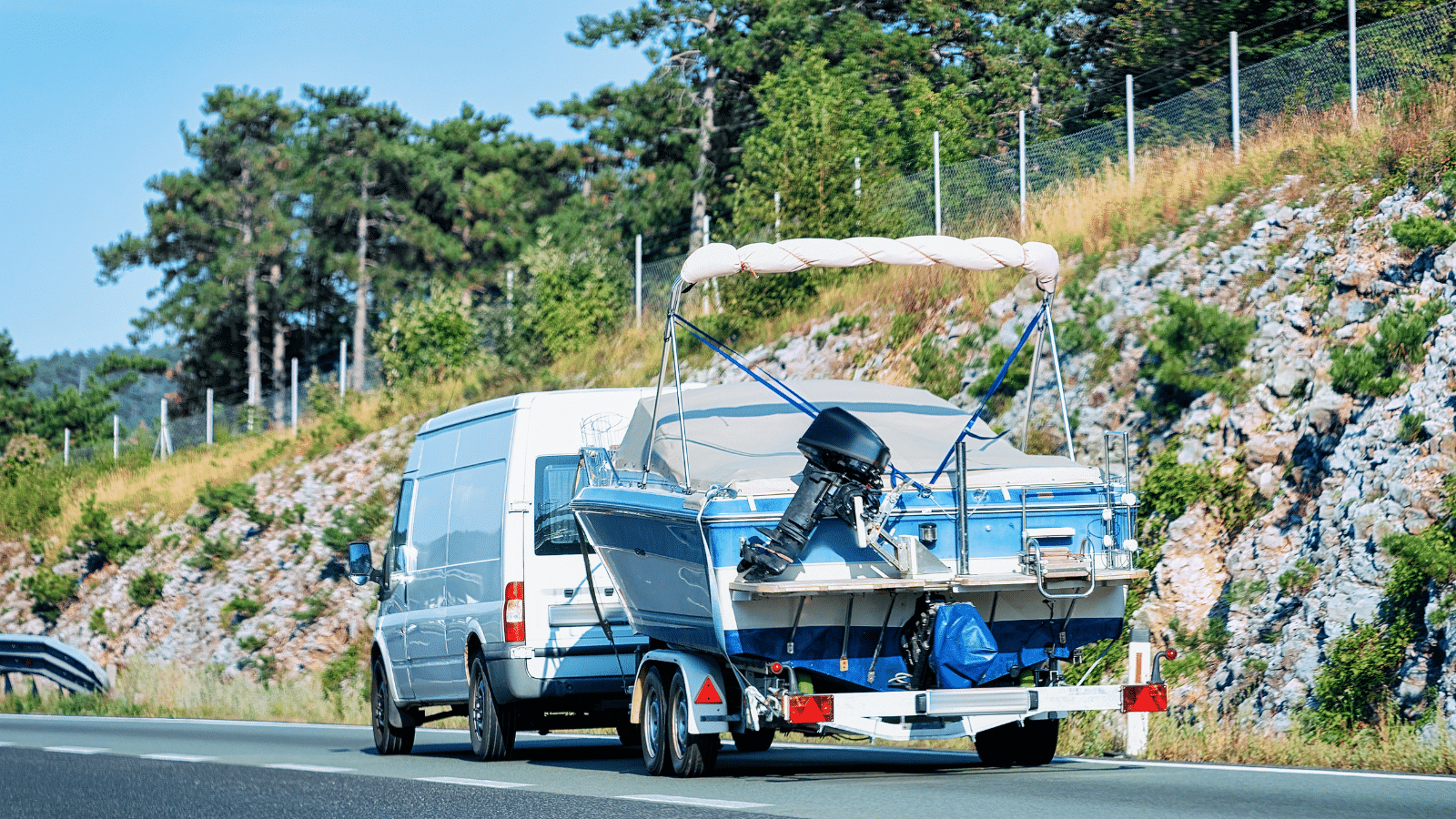

Luxury Boats and RVs

Luxury cars, extravagant boats, and RVs can be expensive but also have added storage costs. If you buy big, consider how much it will cost to store your luxury items long-term.

Helping Adult Children

It is natural for parents to want to look after their children, no matter what their age. Many retirees are happy to help their adult children out, whether to help them with a deposit on a house or pay for a vacation. While this is a nice gesture, it should not be a regular occurrence if you want your retirement fund to last.

Expensive Tech

When you have a large pot of money in the bank, it is tempting to head to the store and buy that large-screen TV you have been eyeing so you can have your cinema, but tech doesn’t last, and neither does money.

Parties

It is tempting to splash out on friends and family by holding big parties and events. It’s great to have people over or treat friends to lunch now and again, but if you constantly pick up the bill at fancy restaurants or throw weekend-long parties, you will eat through your retirement fund in no time.

Share Schemes

Many people rush to invest their money when they retire, but you must do your homework before you pass over your money. Investing in shares is an excellent way to build your retirement fund, but you will need advice from someone experienced.

Cosmetic Surgery

If you have been tempted to have cosmetic surgery, booking it when you retire is a good idea. The procedures go well for most people, but it is essential to look at the cost of healthcare if the surgery does not go to plan, as your insurance company is unlikely to cover the cost of cosmetic surgery.

Scams

Scammers look to newly retired people who may be vulnerable about their future. From intricate healthcare scams to financial scams that promise people lots of money, retirees should be careful they are not sucked in by evil people.

Move To An Expensive City

If a big move is on the cards when you retire, it should be well thought out, including a full financial assessment. Some cities are more expensive than others, and many retirees have been caught out by not considering a higher cost of living.

Not Looking for Discounts

It’s not necessarily a big spend, but when retirees do not check out store discounts for retired people, they could lose significant savings. Even small discounts add up, so it is wise to get money off.

Credit Card Debt

Some people will hit their credit cards when they retire to keep their principal bank balance flowing. While this can be an intelligent move at times, keeping an eye on interest rates and a soaring credit limit is essential, as it can bite you in years to come.

Shopping Sprees

It’s great to have fun shopping days with friends or your other half, but one shopping trip can turn into many, and before you know it, your retirement fund is on its last legs.

Collecting Social Security Too Early

Many people spend their social security money too early when it is best to wait a while until they really need it. It may be tempting to get all the money you can straightaway, but there may be better moves than this, as many people have learned the hard way.

Paying More Tax Than They Need To

Taxes are complicated, and retirees may become overruled with what they should and should not pay when they retire. Getting sound financial advice from an expert can help retirees avoid paying too much tax that would seriously dent retirement funds.

21 Things That Shout You’re “Lower Class” According To Men

Class wars creep up in all aspects of life, including dating. We take a look at the things that men believe are telltale signs that you are lower class.

21 Things That Shout You’re “Lower Class” According To Men

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

The change in the automotive industry has been incredible over the year. Baby boomers born between 1946 and 1964 can’t get enough of the cars listed below, as muscle cars emerged in the 1960s, and new technologies appeared in the 1970s and 1980s. You can imagine why boomers genuinely appreciate these vehicles.

Boomer Zoomers vs. Millennial Meh: 10 Cars the Older Gen Loves but Millennials Just Can’t Stand

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

There is a lot to love about America, from the bright lights of New York to the incredible breakfasts, but foreigners also dislike many things. We look at everything from poor public transport to an intimidating tip culture, sharing 18 things that America could be better at.

Across the Pond Disdain: 18 Horrendous American Habits Foreigners Just Can’t Stomach

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

While some old habits die hard, there are some things that Gen X need to eliminate as they are no longer relevant.

Out with the Old: 18 Gen X Fads That Millennials and Gen Z Just Can’t Vibe With

18 Unpleasant States You Might Want to Skip on Your Next Trip

When thinking of America, we don’t expect there to be boring or unpleasant places to visit. We see all the different states on the TV, and they show the best parts. However, there are some states you won’t want to visit, and you should brace yourselves if you ever happen to stumble into them.

18 Unpleasant States You Might Want to Skip on Your Next Trip